PAN (Permanent Account Number), is a 10-digit identification card issued by the Income Tax Department. If you’ve recently moved to a new address and need a PAN card address correction, it’s important to update your PAN card address to ensure that your important financial documents reach you in a timely and secure manner.

Fortunately, changing your PAN card address is a relatively straightforward process, and can be completed quickly and easily online. Here’s how to change your PAN card address:

Step-by-Step Process to Change PAN Card Address?

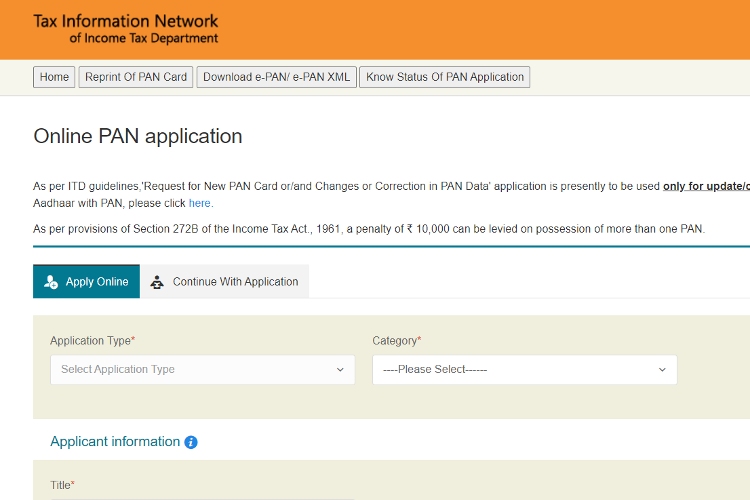

Step 1: The first step in changing your PAN card address is to visit the NSDL website. NSDL is the government agency responsible for processing PAN card applications and updates.

Step 2: Once you’re on the NSDL website, click on the “Apply Online” button.

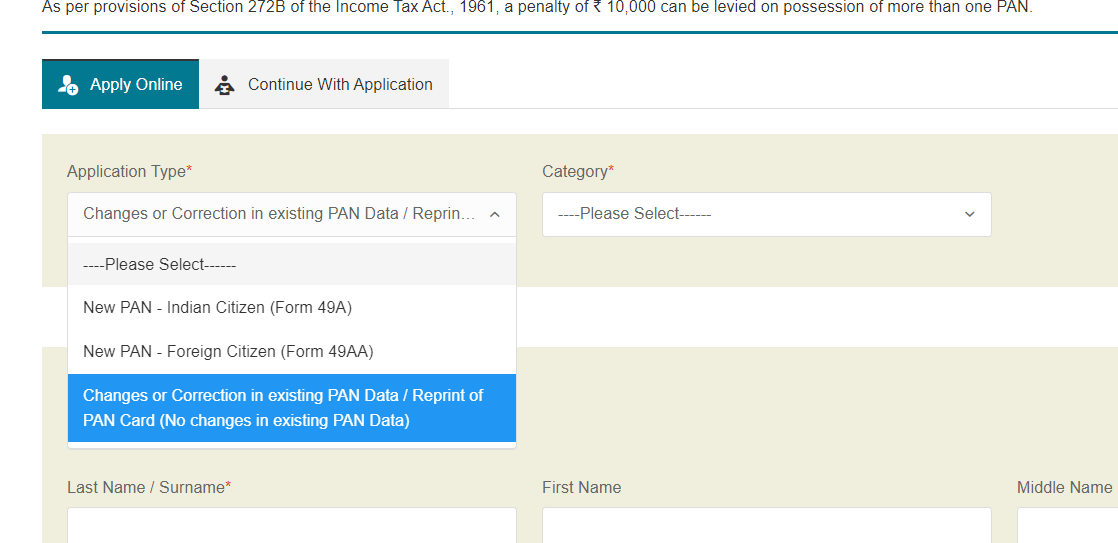

Step 3: Select “Changes or Correction in existing PAN Data/Reprint of PAN Card.” in the application type.

Step 4: From the Category option select individual if the PAN is under your name.

Step 5: Fill out all the details asked in the form, i.e., name, DOB, email, phone number

Step 6: Complete the captcha and click on the submit button.

Step 7: You’ll be provided with a temporary token number once this process is completed to track your application.

Step 8: You’ll be redirected to the next page where you will be asked to upload scanned copies of your proof of identity and proof of address documents.

Step 9: Make sure that the “Submit digitally through eKYC” option is selected.

Step 10: Fill in all the necessary details (Father & Mother’s name, Aadhar number) and click on the next button.

Step 11: You will be redirected to the next page where you can update the address details.

Step 12: Submit all the documents required in the proof.

Step 13: Sign the declaration and click on the submit button.

Step 14: You will be redirected to the next page where you can pay the processing fee using a credit/debit card, demand draft or net banking.

Step 15: After the payment is completed an acknowledgement receipt will be generated which you will have to print out.

Step 16: Envelop this printout along with 2 passport-sized photos of yours attached with the printout, signed across them, along with the self-attested copies of the proof documents and the DD with the acknowledgement number mentioned at the back of the DD. Write “Application for PAN change” along with the acknowledgement number on the envelope and send it to the official NSDL address below:

NSDL e-Gov at Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk, Pune – 411 016′

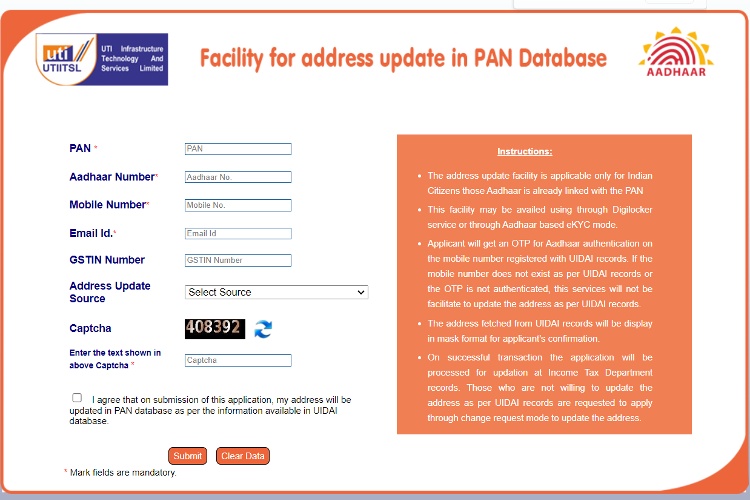

Step-by-Step Process to Change PAN Address Using Aadhaar Card:

- Visit the UTIITSL website, you will be directed to the following page:

- Fill in your details like PAN number, Aadhaar number, email ID, mobile number, GSTIN and source of address update.

- Select the ‘Aadhaar Base e-KYC Address Update’ option to update your address using your Aadhaar card.

- Type in the captcha and agree to the terms and conditions.

- Hit ‘Submit’.

- You’ll get a one-time password (OTP) on your Aadhaar-linked email ID and mobile number.

- Enter the OTP and click ‘Submit’.

- Once you’ve completed all the steps, your residential address will be updated based on the information on your Aadhaar Card. You’ll also get an email and text confirming the update for your security.

Documents Required to Change PAN Card Address:

Before you begin the process of changing your PAN card address, you’ll need to gather a few important documents. Depending on which category you belong to, there can be different documents that need to be submitted. These include:

1. If you are an Individual or belong to HUF:

- Proof of PAN (for PAN number):

- A copy of your PAN Card.

- A copy of your PAN allotment letter.

- Proof of Identity(any one of these is applicable):

- Your Aadhaar Card.

- Electoral Photo Identity Card/Voter ID card

- A Driving license copy

- A Passport Copy

- A Ration card with your photo on it

- A License to Bear Arms

- A Photo ID card issued by the central/state government or any PSU

- Pensioner card with a photo

- Identity Certificate signed by a Parliament member/Gazetted officer/Municipal Councilor

- Original bank certificate with your photo on letterhead signed and stamped by the issuing officer.

- Proof of address(any one applicable):

- Your Aadhaar Card.

- Employer certificate in the specified format.

- Address signed by an MP/MLA.

- Address certificate signed by a Gazetted Officer.

- Address certificate signed by a Municipal Councilor.

- Landline bill copy.

- Broadband connection bill copy.

- Water bill copy.

- Gas connection card.

- A copy of the statement of the Bank account.

- A copy of the Statement of Credit card.

- Document of Property registration.

- A letter of accommodation by the State/Central Government if you have been allotted a house from the government. The letter should be at the most three years old.

- Domicile certificate issued by the state government.

- Latest property tax assessment order.

- The post office passbook has your address mentioned.

- Passport

- Your wife’s/husband’s passport.

- Driver’s License.

- Electoral/Voter ID card.

- DOB Proof

- Your Aadhaar Card.

- Driver’s License.

- Electoral/Voter ID card.

- Birth certificate issued by the municipal authority

- Domicile certificate issued by the state government.

- Passport

- Mark sheet of recognised board

- Birth certificate from the municipal corporation

- Photo ID card issued by the state/central government

- A copy of the PPO

- Marriage certificate by the marriage registrar

2. If you are a company situated in India or an unincorporated entity formed in India:

- Certificate of Registration that has been issued by the Company registrar

- Certificate of Registration that has been issued by the firm’s registrar or the partnership deed if you are a partnership firm.

- Certificate of Registration that has been issued by an LLP Registrar if you are an LLP.

- A trust deed or a copy of the Charity Commissioner-issued certificate of registration number.

3. If you are not an Indian citizen belonging to the Individual or HUF category:

Identity proof:

- Passport

- A copy of the OCI card

- A copy of the PIO card

- A copy of the citizenship ID Number issued by another country that has been duly attested by either the Indian Embassy, the High Commission or the Consulate in the country of your residence. You can also get it attested by “Apostille”.

Address Proof:

- Passport

- A copy of the OCI card

- A copy of the PIO card

- A copy of the account statement from the resident country’s bank

- A copy of the NRE account statement

- Residential certificate in India or permit of residence issued by the state police

- Certificate of registration that has been issued by the Foreigner’s Registration Office that shows an Indian address.

- A copy of the VISA or appointment letter

- A copy of the citizenship ID Number issued by another country that has been duly attested by either the Indian Embassy, the High Commission or the Consulate in the country of your residence. You can also get it attested by “Apostille”.

What Are The Charges for the PAN Card Address Change?

- If you choose to submit a physical application at the TIN centre, you will have to pay Rs. 107(if given an Indian address for communication), or 1017(if given an overseas address for communication)

- For online submissions, you will have to make a payment of Rs.110 if you are located within India, and Rs.1,020 if you are located outside India.

- If you haven’t made any updates and only wish to get your PAN reprinted, you will have to pay a sum of Rs. 50 if you are located in India and Rs. 959 if you are located outside India.

- If you do not want a physical copy of the updated PAN card, you will have to pay a sum of Rs. 66 only. (additional charges for eKYC may apply.)

In conclusion, changing your PAN card address is a relatively straightforward process that can be completed quickly and easily online. Just make sure that you have all of the required documents on hand, and double-check all of the information you enter to avoid any errors. With a little bit of patience and persistence, you’ll have your updated PAN card with your new address in no time.