The Finance Ministry launched the facility for online allotment of Instant PAN through Aadhaar card in the middle of 2020. It helps ease the otherwise painful process of PAN allotment, which involves filling up a lengthy application form and furnishing tons of documents.

Requirements of Instant PAN through Aadhaar Card

The following are the basic requirements for obtaining an instant PAN through Aadhar card based e-KYC:

- The applicant must have a valid Aadhaar number that has never previously been connected to another PAN.

- The Aadhar number of the applicant must be connected to the registered mobile number.

- Applicants do not need to send or upload any KYC documents because the instant PAN through the Aadhaar card service is a paperless operation.

- An applicant cannot have more than one PAN Card. Under the provisions of Section 272B(1) of the Income Tax Act, 1961 applicants who have more than one valid PAN will be penalised.

How to apply for an Instant PAN Card through Aadhaar Card?

Follow these steps to apply for PAN using your Aadhaar:

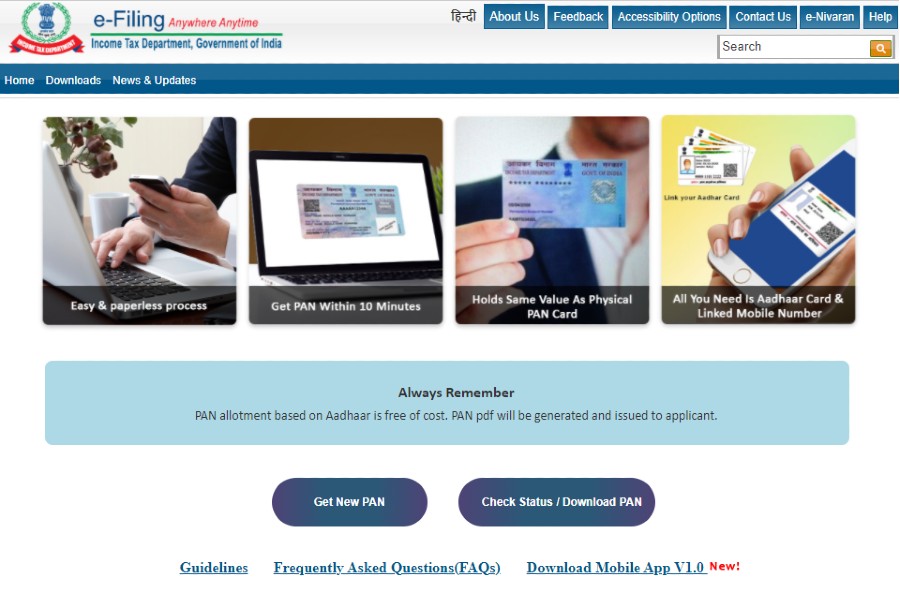

- First, you’ve got to open the e-filing website of the Income Tax Department.

- Now click on the ‘Get New PAN’ tab.

- You’ll need to enter your 12-digit Aadhaar number here.

- An OTP will be generated and sent on the Aadhaar registered mobile number. Submit that.

- A 15-digit acknowledgment number will now be generated.

- A few other details will be asked for in the user info.

- When you’ve done that, a PAN will be allotted to you. You can download an e-PAN card from the portal. The e-PAN is also sent to your registered email ID.

As you’ll notice, the process is completely paperless and takes about 10 minutes. It’s free of cost and has been successfully used by over six crore Indians.

FAQs

Here are some frequently asked questions with regards to this new facility:

1. What is e-PAN?

A. e-PAN is a digitally signed PAN card issued in electronic format by the Income Tax Department of India using Aadhaar e-KYC.

2. Is this PAN, allotted through Aadhaar, valid? Is it different from the PAN issued via other modes of application?

A. Yes, absolutely! This PAN is valid. It is not different from the PAN issued by the Income Tax Department via other modes of application. That said, the PAN allotted through Aadhar has significant advantages, such as it’s paperless, online, and free of cost.

3. If I apply for an instant PAN through Aadhaar, how will I get the allotted PAN?

A. You can download your PAN by submitting the Aadhaar number at Check Status of PAN. You will also get the PAN in PDF format on your email, if your email-id is registered with your Aadhaar.

4. Can I use this facility if I already have a PAN? Can I apply for another PAN?

A. How do you need a PAN card when you already have one? And to answer the question, no. As per provisions of Section 272B(1) of the Income Tax Act, a person having more than one PAN has to pay a penalty of ₹10,000.

5. Who can apply for allotment of instant PAN through Aadhaar e-KYC?

A. All PAN applicants who have an Aadhaar number from the Unique Identification Authority of India (UIDAI) and have registered their mobile number with Aadhaar, can apply for PAN through this facility.

6. Can I apply for an instant PAN if my Aadhaar Card is not active?

A. No, you cannot apply for this facility if your Aadhaar isn’t active.

7. What if I do not get an OTP?

A. You can resubmit the Aadhaar e-KYC page to get a new OTP. If you still don’t get an OTP, you need to contact UIDAI.