Any individual having an income of over ₹2,50,000 must report it to the Government of India. He/she can do so by filling a form called income tax return, or ITR.

The document declares the annual income, tax payments, and deductions of a taxpayer, although that doesn’t mean people without any income cannot file for an ITR. The Income Tax Department, in fact, encourages all citizens of India to file their ITR.

Who needs to file ITR?

As alluded to earlier, an ITR is mandatory for individuals having an income of over ₹2,50,000. The same goes for companies, even if they’re not making a profit in a financial year. Non-Resident Indians commonly referred to as NRIs, must also mandatorily file ITR if they’re earning anything from India.

ITR can also be filed by individuals having an income of less than ₹2,50,000, or having no income at all. Meanwhile, senior citizens between 60-80 years that have an income of over ₹3,00,000 in a financial year must also compulsorily file ITR. The same goes for citizens over 80 years, who have an annual income of over ₹5,00,000 in a financial year.

Why do people file ITR?

Filing ITR is quite important as it helps the taxpayer report his/her income for a financial year, claim an income tax refund, carry forward losses, or claim tax deductions.

How do you file ITR?

ITR can be filed either offline or online. Keep the following documents handy no matter which filing method you choose:

- PAN card

- Your bank account details, like bank name, branch, account number, and IFSC.

- Form 16

- Details of all the investments that you have made.

- Aadhar card

- The previous year’s return, if applicable.

- TDS certificate

Steps for filing ITR offline are:

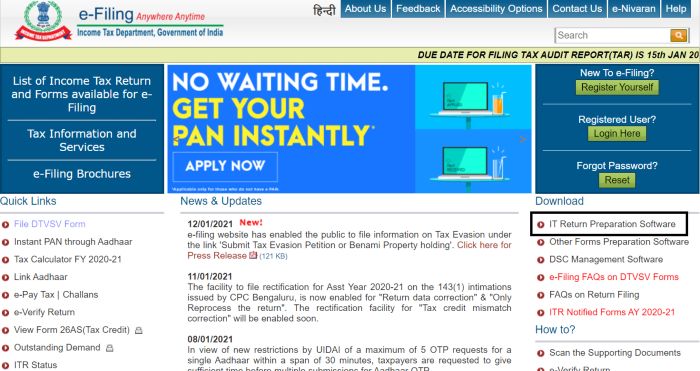

- Visit the official website (www.incometaxindiaefiling.gov.in) for filing ITR.

- Now click on “Downloads”, which is below the “Login button”. Select “Offline Utilities”, followed by “Income Tax Return Preparation Software”.

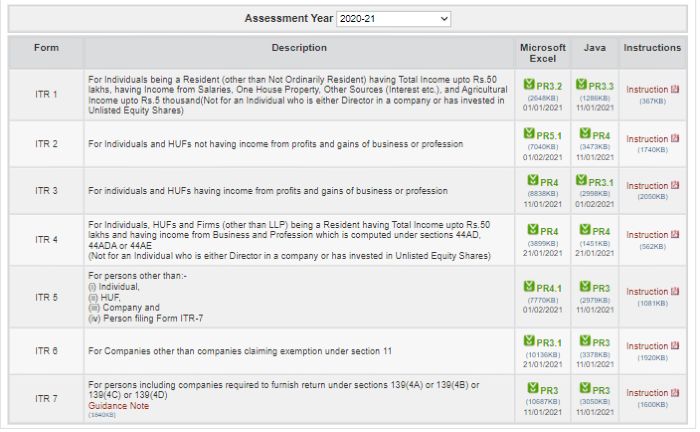

- You must now select the applicable ITR form, which is dependent on your type of income. It can be anything of these:

- ITR 1: This form is for those individuals who earn income from salary, from a single residential property, and have other income sources such as interest earnings, where the cumulative income in a financial year is up to ₹50,00,000.

- ITR 2: Choose this form if you’re an individual or member of Hindu Undivided Families (HUFs) not earning any income from a profession or business.

- ITR 3: Go with this form if you’re an individual or member of Hindu Undivided Families (HUFs) not earning any income from a profession or business.

- ITR 4: Applicable for individuals, HUFs, or firms using the presumptive taxation facility.

- ITR 5: Applicable for Body of Individuals (BOIs), Limited Liability Partnership Firms, Association of Persons, and firms.

- ITR 6: For companies not claiming any kind of deduction under Section 11 of the IT Act.

- ITR 7: Applicable for companies and individuals who file ITR under Section 139(4A/4B/4C/4D4E/4F) of the IT Act.

Select the applicable form in either of the two different utilities: Excel and Java as shown below. Click on the download link to get the selected form in the chosen format. You’ll get a ZIP file, which needs to be extracted.

- Enter the necessary fields in the form. Ensure that you validate the data and calculate taxes carefully.

- Now select the “Generate XML” option, following which click on the “Save XML” option. This allows you to save your ITR form at the desired location on your computer.

- Register on www.incometaxindiaefiling.gov.in, if you haven’t already. Login using the provided ID, password and click on “e-File”, followed by “Income Tax Return”.

- Choose the “AY” (Assessment Year) and the appropriate “ITR Form”.

- Under “Submission Mode”, select “Upload XML”. Click “Continue” and attach the XML File.

- Complete the verification of your returns. You will get a confirmation email on the successful submission of the return.

Steps for filing ITR online are:

- First, you’ll need to log in or register yourself on the e-filing portal. To do so, visit the official website (www.incometaxindiaefiling.gov.in). Click on “Login Here” if you’ve registered yourself already and have a valid ID and password. If you’re not registered, select the “Register Yourself” option and fill the registration form to get your ID and password.

- Now select the “User Type”. This is a mandatory step In order to register yourself with the Income Tax Department. The available options are Individual, Hindu Undivided Family (HUF), Other than Individual/HUF, External Agency, Chartered Accountants, Tax Deductor and Collector, and Third-Party Software Utility Developer. You’ll also need to enter your current address and your permanent address. Do the same, enter the Captcha code and hit ‘Submit’.

- Your basic details need to be filled in. This includes your name, your PAN, and your date of birth (DOB). Your contact details, such as your mobile number and email ID are also required.

- PAN verification is the next step. Once that’s done, your transaction ID and contact details will appear on the screen.

- An activation link will be sent to your email ID. Use it to activate the account.

- Now that your account is open, follow this procedure to file your ITR online:

- Collect the required documents, such as TDS certificates (Form16/16A), capital gains statement, among others.

- Download and check Form 26AS, which is basically your tax passbook that consists of all the details of the tax that has been deducted from your income during the said FY and deposited against your PAN.

- Look out for errors in Form 26AS and rectify them.

- Compute your total income for the said financial year. Be careful with this.

- The next step is computing your tax liability. This will be dependent on the tax rates in force for that FY as per your income slab.

- Calculate final tax payable, if any, by deducting the taxes that have been already paid by you through TDS, TCS, and Advance Tax during the year.

- You can now start filing your income tax return after all taxes are paid.

- Once you’ve done that, verify your ITR. The IT department will send you an email confirming that your ITR has been received.

- The IT department will now process your return. You’ll be notified by mail after completion.