Employed individuals or those running a business need to pay tax on their income. This is called Income Tax and is regulated by the Income Tax Department, which is sometimes also referred to as the IT Department or ITD. It’s a government organization that functions under the Department of Revenue of the Ministry of Finance. The Income Tax Department is headed by the apex body Central Board of Direct Taxes (CBDT).

Income tax should, preferably, be paid on or before time to avoid any late charges. You can do it yourself or through a Chartered Accountant, and the online mode of payment is easier and more convenient. When you’re paying Income Tax online, by yourself, you’ll have to fill a form called Challan 280.

What is Challan 280?

Challan 280 is a form that you can use for income tax payment of self-assessment tax, tax on distributed income and profit, regular assessment tax, advance tax, and surtax. It’s primarily meant for individuals paying Income Tax by themselves, either online or offline. The form, which is also sometimes referred to as ‘ITNS 280’, on the official website of Income Tax India.

The biggest benefit of using this form is that it removes the dependency on a third person. You don’t need to rely on a Chartered Accountant or your employer. You can simply download it for making the payment all by yourself.

How do you download the Challan 280 form?

Here are the steps to follow when looking to download the Challan 280 form online:

- Go to the official website of Income Tax India. Here it is – www.incometaxindia.gov.in.

- You’ll see the ‘‘Forms/Downloads’ option on the home page. Click on that.

- Under it, there’ll be a ton of other options. You have to select the ‘Challans’ option.

- You will be redirected to a new webpage. There’ll be an exhaustive list of all the downloadable Challans.

- Carefully click on the ‘ITNS-280‘ option. It is located at the top of the list.

- Now, there are two different formats for the Challan. A PDF format and a Fillable form. Pick the one that suits you the best. The form will now be downloaded.

What are the steps for paying your Income Tax online with Challan 280?

Follow these steps if you’re looking to pay your Income Tax online using Challan 280:

- Go to the official website of National Securities Depository Limited (NSDL) (https://www.tin-nsdl.com/).

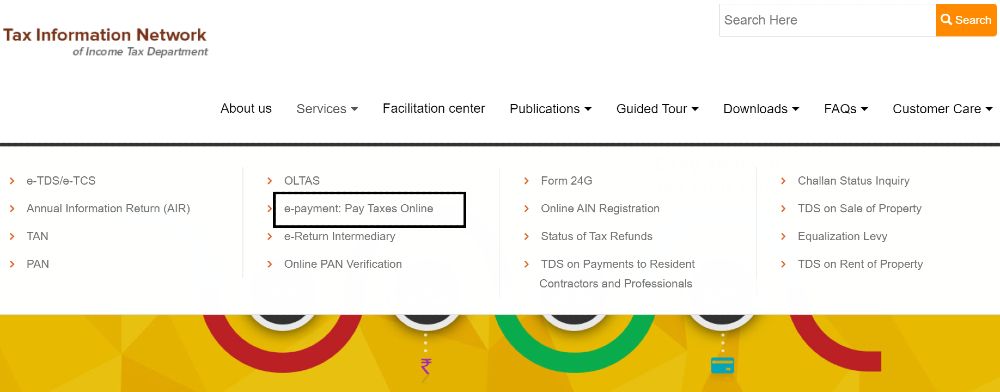

- The home page will appear. Now click on the ‘Services’ tab. A drop-down list will now appear.

- From the menu, select the ‘e-payment: Pay Taxes Online’ option.

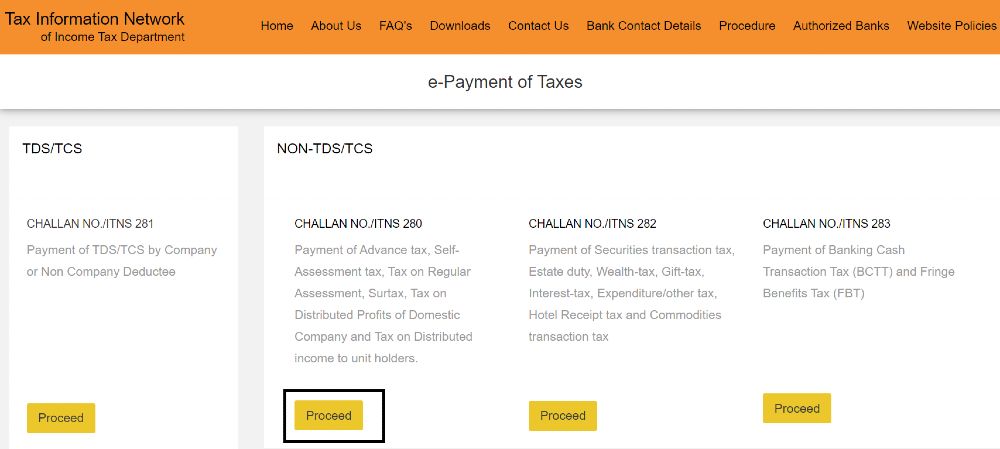

- You will now be directed to the ‘e-Payment of Taxes’ page. If you don’t want to do that, you can alternatively go to the ‘Pay Taxes Online’ box, which you’ll see on the right side of the main page of the website. Here you have to choose ‘Click to pay tax online’ to directly access the ‘e-Payment of Taxes’ page.

- You’ll see a bunch of options here, four in total. Choose ‘Challan No./ITNS 280’ from the options and click on the ‘Proceed’ button.

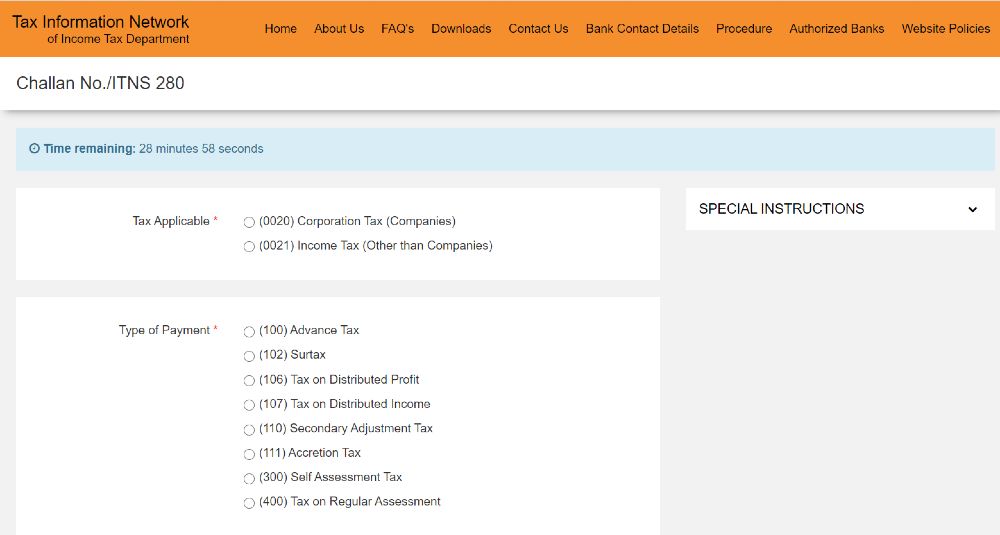

- Coming to the next page, you can view the challan. You’ll need to fill in details like your applicable tax, the Permanent Account Number (PAN), and the assessment year, among others.

- Select (0021) Income Tax (Other than Companies) option for paying your Income Tax.

- Now you’ve got to select the type of payment correctly. Here are the options at your disposal:

- (100) Advance Tax

- (102) Surtax

- (106) Tax on Distributed Profit

- (107) Tax on Distributed Income

- (300) Self Assessment Tax

- (400) Tax on Regular Assessment

- In case any taxes are due while filing your Income Tax returns, select ‘Self-assessment tax’.

- Once you’ve made that choice, choose the mode of payment. You basically have two modes of payment to choose from Net banking or Debit Card. When you select either of these, a list of bank names will appear.

- Your PAN details will be required here. After doing that, select the relevant Assessment Year (AY) from the list that appears. For the period 1st April 2018 to 31st March 2019, the relevant AY is 2019-20.

- It’s now time to enter your personal details. Fill in everything, like your address, district, state, pin code, e-mail ID, and mobile phone number. Double to ensure that all the details are correct.

- A screen appears with the Captcha code. Enter it in the given space and hit ‘Proceed’.

- You’ll be led to an ‘e-Payment page’. This is where you’ll make the Income Tax payment. Once over that, the procedure is complete.

Can you make corrections to the Challan after submitting it?

Yes, absolutely! Changes can be made in the Challan. You’ll have to request for a change, although bear in mind that only the following fields can be edited in the form:

- Assessment Year

- Tax Deduction and Collection Number (TAN) or Permanent Account Number (PAN)

- Nature of the payment

- Major Head Code and Minor Head Code

- The total amount

Mistakes in the Assessment Year are more common than the others. The Assessment Year is the year in which your taxes are assessed, meaning it will be the year following the year for which you are paying your taxes.

Follow these steps if you’re looking to make changes to the Assessment Year in the Challan:

- While filing your IT returns, don’t forget to mention the payment details, even if you have chosen the wrong assessment year.

- Request the error in the challan to be corrected by the office of the jurisdictional assessing officer. You’ll find the details of this on the Income Tax Department’s e-filing website.

- If you’ve managed to spot the mistake within seven days of making the deposit, you can request the correction to be made in the challan by the bank itself.

- Once you’ve done that, a notice will be sent by the Assessing Officer (AO) after processing your returns, since the payment details will not match the records.

- Ensure that you respond to the notice with details of the error.

- Thanks to Section 154, you also have the right to submit a rectification of the error.

- The Assessing Officer can make the required corrections in your challan if your rectification request were verified as accurate. The matter is then closed.