The Employees’ Provident Fund (EPF) is, by far, the most popular government-backed savings scheme in India. The EPF, which is more commonly called PF, was started decades ago by the Government of India in order to help employees in the public, as well as private, space to save themselves enough money for retirement.

Under this scheme, employees working in the public and private sectors contribute 12% of their salary in an EPF account. Employers match that contribution.

How do you check EPF claim status?

Before we get into how to check EPF claims, let us first understand what it means. An EPF claim is basically an application for partial withdrawal of funds from EPF. EPFO, which is the organization responsible for EPF, allows contributors to withdraw their funds before retirement.

Now that we are over that, let us get into the heart of the matter. There are two ways to track the status of their PF claim. You can do it either:

- Online, or

- Offline

How to check status of EPF claim online?

There are, again, multiple ways to check EPF status online. You can either do it through:

- The Universal Account Number (UAN) Member Portal

- The EPFO portal

- Using the PF account number without UAN

- Via the Umang app

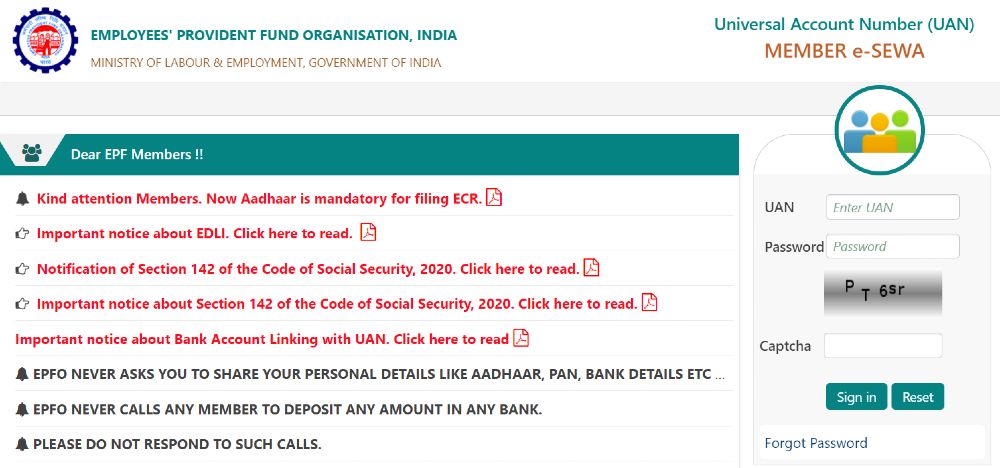

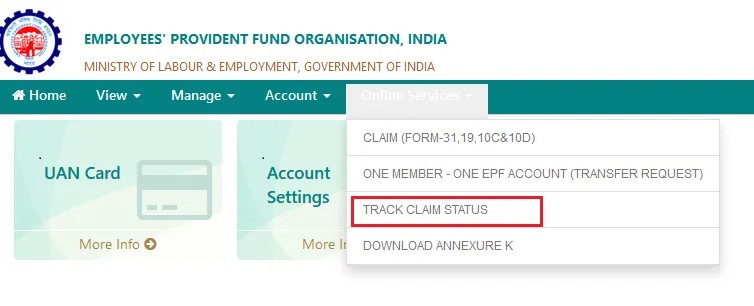

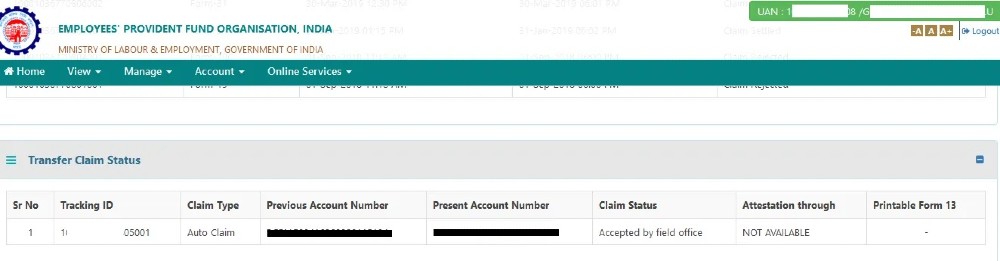

1. Steps to check EPF claim status through the UAN Member Portal:

- Log in to your UAN Member Portal by entering your UAN and password.

- Click on the option ‘Online Services’.

- Next up, click on ‘Track Claim Status’.

- Now, enter details of your withdrawal or transfer status.

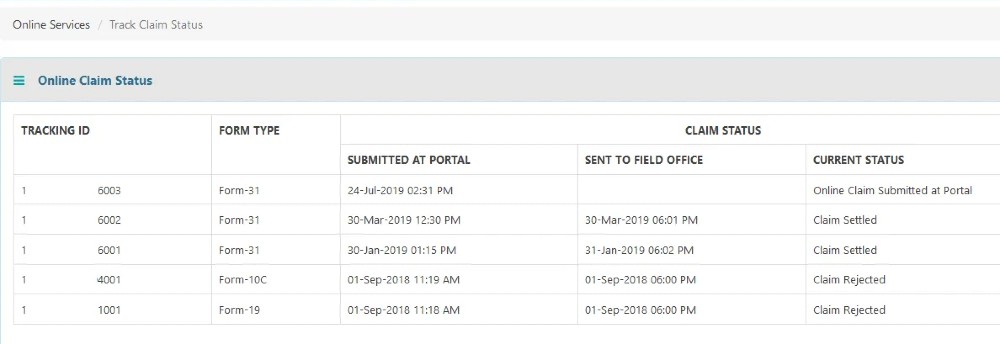

- Once you do that, details of the “Online Claim Status” will appear on the screen.

- Details of “Transfer Claim Status” will appear on the screen once you scroll down.

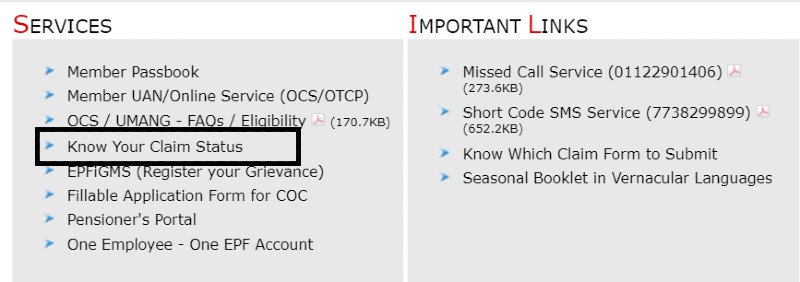

2. Steps to check EPF claim status through the EPFO portal:

- Visit EPFO’s dedicated portal.

- Look for the ‘Our Services’ option.

- From the available tabs, select ‘For Employees’.

- After you are redirected to the next page, select the ‘Know your Claim Status’ under option.

- Correctly enter UAN and CAPTCHA in the respective blocks.

- Keep moving by clicking on the ‘Search’ option.

- Now, select ‘Member ID’.

- This completes the process. Click the ‘View Claim Status’ option to check the progress of your PF claim.

3. Steps to check your EPF claim status using your PF account number without UAN:

- Again, go to the EPFO’s official website.

- Find your way to the ‘Know your Claim Status’.

- Select the ‘Click Here for Knowing the Claim Status’ option.

- Next up, select your respective PF Office State from the drop-down menu.

- Choose your city from the drop-down menu.

- Now, correctly enter your PF account number and hit ‘Submit’.

- Once you do that, your PF claim status will appear on the screen.

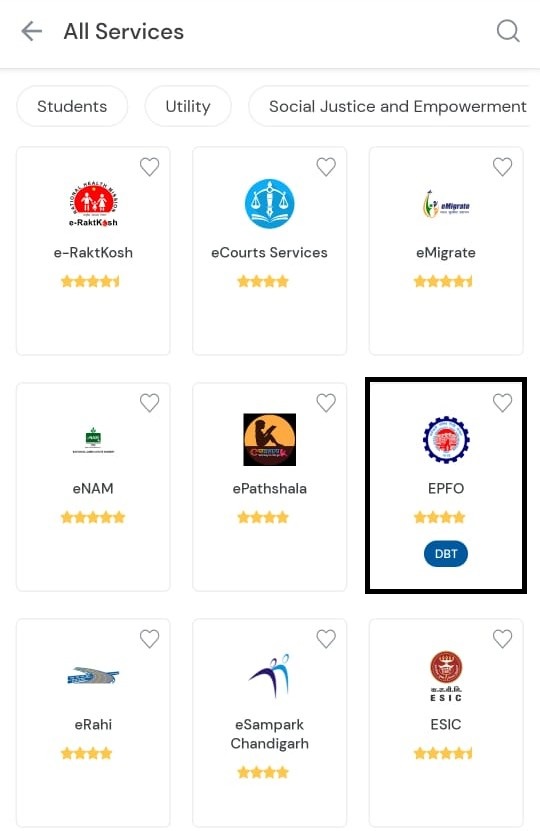

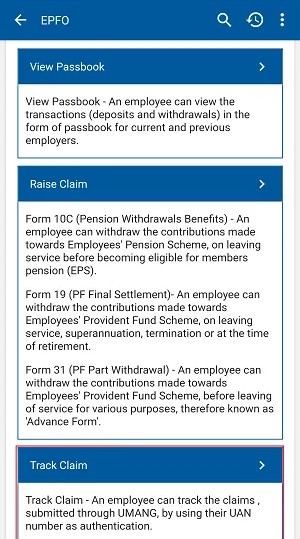

4. Steps to check your EPF claim status via the Umang app:

- Download the Umang app and log in to the app

- Once you have logged in look for the EPF option on the application’s home page.

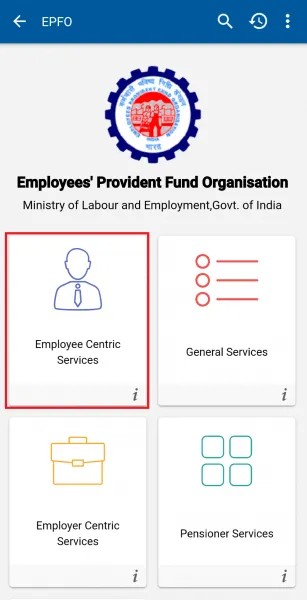

- Select ‘Employee Centric Services’ option.

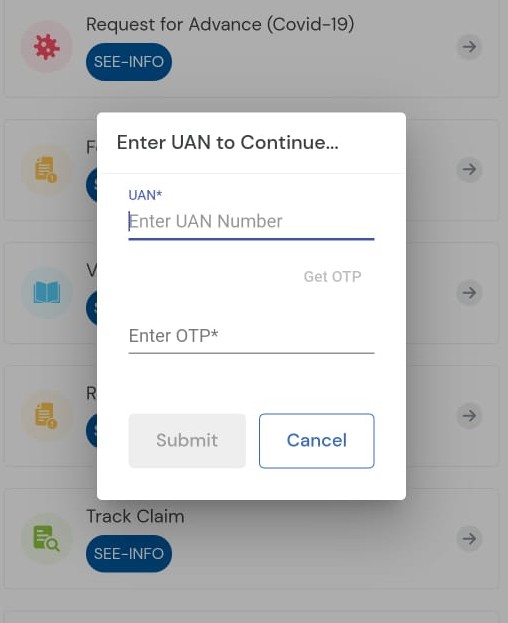

- Now, select the ‘Track Claim’ option.

- Enter the UAN and click on ‘Get OTP’.

- The OTP will be generated. Use it for verification and click on the ‘Login’ option.

- Once logged in, all the UAN claims will be shown. For each claim made to date, the tracking ID, claim type, claim date, and claim status are listed.

How to check EPF claim status offline?

The best way to check your EPF claim status offline is through:

- SMS

- Missed call

1. Steps to check your EPF claim via the SMS:

To check your EPF claim status through an SMS, send an SMS from the mobile number that is linked with the UAN portal to 7738299899. Ensure you follow the SMS format “EPFOHO UAN LAN” before sending where ‘LAN’ is the language in which the employee wants to get information. In this format. The table below is for the different languages and the codes available in the SMS facility:

| Language | Code |

|---|---|

| English | ENG |

| Punjabi | PUN |

| Marathi | MAR |

| Telugu | TEL |

| Malayalam | MAL |

| Hindi | HIN |

| Gujarati | GUJ |

| Kannada | KAN |

| Tamil | TAM |

| Bengali | BEN |

2. Steps to check your EPF claim via missed call:

Alternatively, you can do it by giving a missed call to the toll-free number 011-22901406 using your registered mobile number. But, the employee must link their UAN to their mobile number. On the UAN portal, the employee must also update his or her Aadhaar, Permanent Account Number (PAN), and bank account information.

The employee is not charged for the call because it gets disconnected after two rings. The claim details will be sent to the registered mobile number through SMS.

Why is the PF claim being denied?

Your PF claim may be denied for a variety of reasons. Some of the most well-known are:

- UAN is not linked to Aadhaar

- Incorrect bank account information

- Incorrect date of birth

- incomplete KYC, or

- Failure to meet the prerequisites for withdrawal from the EPF.

What are the various types of forms that can be used to file a claim for benefits?

The following are the various types of forms that can be used to obtain claim benefits:

- Composite Claim Form is used for Final Settlement, Advances, or withdrawal benefits.

- Form 10D is used to apply for a pension.

- Form 10C is used for the Scheme Certificate.

- Form 11 is used for the declaration of the previous service.

- Form 2 is used to nominate family members.

- Form 13 is used to transfer a PF account from one employer to another.

Frequently Asked Questions (FAQS):

1. What does “EPF claim status settled” mean?

Ans: It signifies the EPFO has approved and processed it, and the money has already been transferred to the bank or will be soon.

2. What does EPF claim status show status not available mean?

Ans: It simply implies that your claim has not yet been completed, and as a result, there is nothing in the claim status because it is still pending with authorities. As a result, the claim status on the website is not up to date.

3. What is the difference between Form 10C and Form 19?

Ans: Form 10C is for pension withdrawals, and Form 19 is for Provident Fund withdrawals.

4. Is it possible for an employer to lower their contribution to the EPF?

Ans: No, employers are not allowed to lower their EPF contributions. Employers who lower their contributions are breaking the law.

5. How long will it take to resolve an EPF claim?

Ans: It takes 5-30 days to receive money through the online method, and 20-30 days to get money through the offline method. After EPF settles the account, the EPF website displays a notification indicating that the account has been settled along with the date of the NEFT amount.