The Employee Provident Fund (EPF) is one of the good things about working in India. It’s a mandatory saving scheme that allows employees to regularly put aside a part of their monthly salary, which over years, adds up to a handsome amount. It can be accessed at the time of retirement, or at the end of employment, helping safeguard the individual’s financial interest to an extent.

How does it work?

Every organization with 20 or more employees has been instructed by the The Employee Provident Fund Organization (EPFO) of India to contribute a part of the employee’s salary in the PF.

The rule states that 12 percent of the salary must go towards PF contribution. The employer contributes their part as well, which is also 12 percent of the employee’s salary. 8.33 percent of it goes towards the Employee Pension Scheme (EPS), whilst the remaining 3.67 percent is transferred into your EPF.

Why do I need to transfer EPF?

It’s almost impossible to keep working for the same company your whole life. No matter how hard you try, you’ll need a change of environment at some point or the other. And this why you’ll need to transfer your PF. Your account with the previous employer won’t work after you quit and join a new firm.

Thanks to this facility, you don’t have to close the old account and withdraw the funds, which if you do, is actually taxable in case the account was terminated before five years. Hence, it’s better to transfer the funds from the old account to the new.

The Employees Provident Fund Organisation’s (EPFO) official website has an option that allows you to do so. You’ll only need to submit a copy of Form 13 to your employer.

Is there an eligibility criteria?

Yes, there are certain conditions that have to be met if you want to successfully transfer your EPF. These are:

- You should have activated your Universal Account Number (UAN) on the EPF portal. Read on to find out more about UAN.

- You need to seed the same account number and IFSC code that have been verified by your employer when you’re putting in the transfer request.

- Your Aadhar should be seeded in the UAN as well.

- Your Date of Joining (DoJ) and Date of Exit (DoE) needs to be mentioned on the portal, along with the reason for the exit.

- Also bear in mind that only one transfer request against one member ID is accepted by EPFO.

What is UAN and how do I use it to transfer PF online?

As alluded to earlier, the UAN stands for Universal Account Number. Like your bank account, the UAN also serves a unique function as it helps keep your EPF deposits safe. It is issued by the Ministry of Labour and Employment, while the EPFO takes care of generating and assigning it to everyone.

The 12-digit number is given to you at the start of your employment journey. Your employer is also handed a UAN, which just like your UAN, stays constant for as long as both you and the company are operational. Once you switch jobs, the EPFO assigns you a new member identification number (ID), which is then linked with your UAN.

As far as its usability while transferring EPF is concerned, the UAN helps connect the account to a new member and makes the whole process really easy. It also helps dynamically update UAN card and generate monthly SMS regarding credit of contribution in EPF account, among others.

Will I need any documents while transferring EPF online?

Yes, you’ll be needing a few basic documents and must ensure some things before you go ahead and begin transferring your EPF online. It includes:

- Revised Form 13

- Valid Identity Proof (Aadhar, PAN or Driving License)

- Old and current details of the EPF account

- The registered mobile number provided at the EPFO website is active

- An active UAN in the UAN portal

- Approved e-KYC from the employer

- Current employer’s details

- Establishment Number

- EPF Account Number

- Salary account details

Step-by-Step Procedure to Transfer Your EPF Online:

Now that you know everything about EPF, UAN, and the documents required, it’s time to begin transferring your EPF.

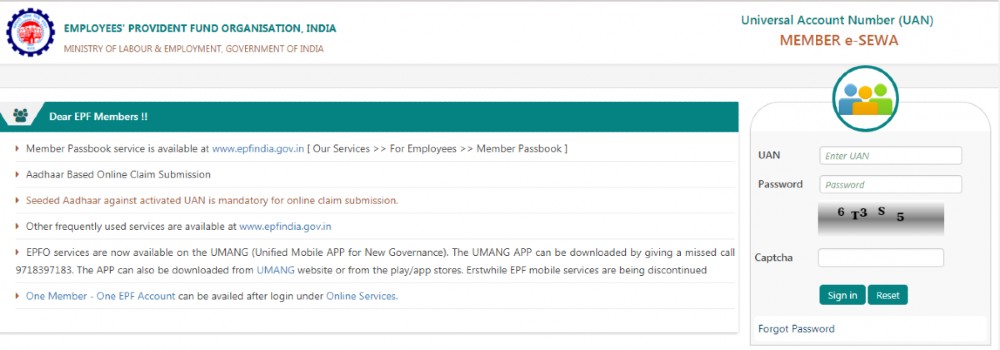

- To begin with, visit the EPFO’s unified portal (https://unifiedportal-mem.epfindia.gov.in/memberinterface/), and log in using your UAN and password.

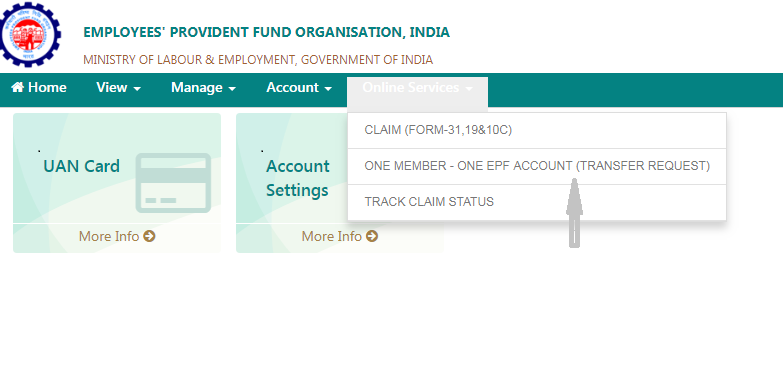

- Now you’ll be directed to a new page that will have options like ‘Home’, ‘View’, and ‘Account’. Select ‘Online Services’ and then click on ‘One Member – One EPF Account (Transfer Request)’ from the drop-down.

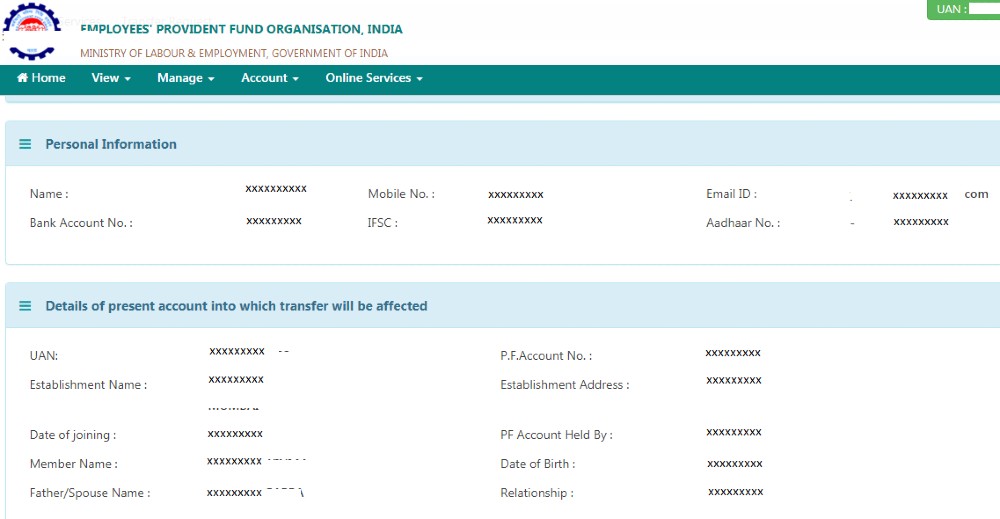

- You’ll see all your information here. Carefully go through each and every detail, and ensure there’s no error. Double-check everything as you can’t change after you’ve saved it.

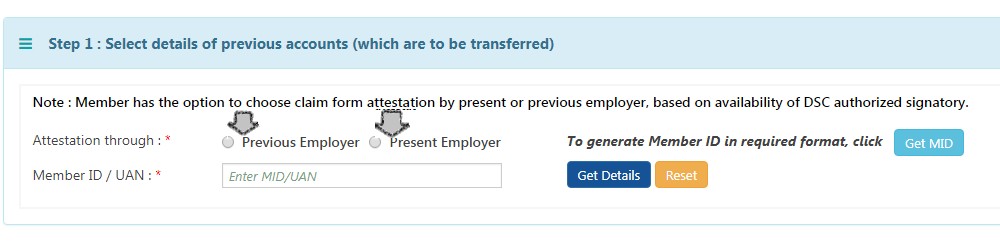

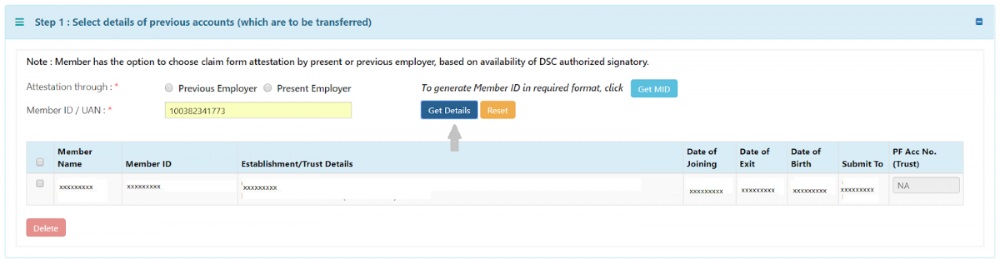

- It’s time to submit the transfer request for attestation. You’ll notice that you can select either your present or previous employer.

- To get your EPF account details with your previous employer, simply select ‘Get Details’.

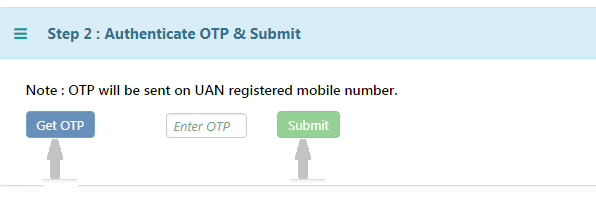

- Make your choice and click on submit. This generates a One-Time Password (OTP) that is sent to the UAN registered mobile number.

- Enter the OTP Code in the tab and click on ‘Submit’.

- Your employer will be digitally notified about the transfer request. They’ll verify the details and approve it, following which the EPFO processes the claim.

- Upon approval, the process is deemed completed and your funds are transferred to your new employer.

Track your claim status

The EPF also allows you to track your transfer request claim. You can do this by using either your Member Claim Status Link, or the EPFO portal, or the website. As far as the details are concerned, you’ll only need your UAN and Password, although that may not be needed either if you track the claim using the Member Claim Status Link.

EPF works, even today

Unlike other investment instruments, EPF doesn’t come with any risk. It isn’t dependent on the market, which means you’ll get your money even if the country plunges into recession. The EPFO, meanwhile, also offers the benefits of compound interest, which helps grow your money year-on-year. Using the same EPF account for more than 10 years, additionally, makes you eligible for a pension after you turn 58.