Employees’ Provident Fund (EPF) is a simple scheme, wherein an amount equivalent to 12% of your salary is deducted every month as a contribution to PF, with your employer also contributing the same amount. To check your PF balance you do not have to wait for your employer to share your EPF statement at the end of the year to know the balance.

The hallmark of a good investor is that he/she is always aware of how much they’ve invested and how much they’re making from it. Checking your EPF balance is a good habit that you must learn if you haven’t already. Unlike the pre-internet era where employees had to wait for their employer to furnish their EPF statement at the end of every year, checking your EPF is now quite easy and doesn’t take much time either.

How to check your PF Balance?

There are basically two ways to go about it; the offline and the online mode. You can check your EPF balance offline by:

- SMS

- Missed call service

As for the online mode, it involves the use of:

- The EPF Portal on mobile or desktop

- Umang app on mobile

Let’s now look at both these modes in detail.

Offline mode

As alluded to earlier, you can check your EPF balance offline either via SMS or a missed call.

Checking your PF Balance via SMS:

- Use your registered mobile number to send an SMS to the Employees’ Provident Fund Organisation (EPFO) to fetch information about your account.

- The SMS Format to be used for sending balance inquiry to the EPFO is:

EPFOHO UAN to 7738299899

Now, you will get a reply in English. If you want a reply in the language you can understand, add the language code in the SMS.

The 10 different languages you can get a reply in are:

- English (Default)

- Hindi (HIN)

- Gujarati (GUJ)

- Punjabi (PUN)

- Marathi (MAR)

- Kannada (KAN)

- Malayalam (MAL)

- Tamil (TAM)

- Telugu (TEL)

- Bengali (BEN)

Here’s an example: Let’s suppose you need balance details in Hindi or Marathi or Bengali. Your SMS will look like this:

EPFOHO UAN HIN to 7738299899

EPFOHO UAN MAR to 7738299899

EPFOHO UAN BEN to 7738299899

Note, however, that this facility can be used only if your Universal Account Number (UAN) is active and seeded with your Aadhaar, Bank Account, and PAN. First, complete your e-KYC with UAN if you haven’t seeded your UAN with these details.

Checking your PF Balance via Missed-Call service:

Here’s your guide to checking your EPF balance through the missed call service:

- Give a missed call on 011-22901406.

You’ll receive the details of your last contribution, along with the PF balance. However, before using this facility, ensure you meet the following requirements:

- Your UAN is activated.

- Your mobile number is registered with the UAN since the missed call will be valid only when made from the registered number.

- Your UAN is seeded with other important documents like Bank Account, PAN, and Aadhaar.

Online mode

That was the offline mode. You can, however, choose to check your EPF balance through the EPF portal or the Umang App.

Checking your PF Balance through EPFO Portal:

- Visit the EPFO’s official website. (www.epfindia.gov.in)

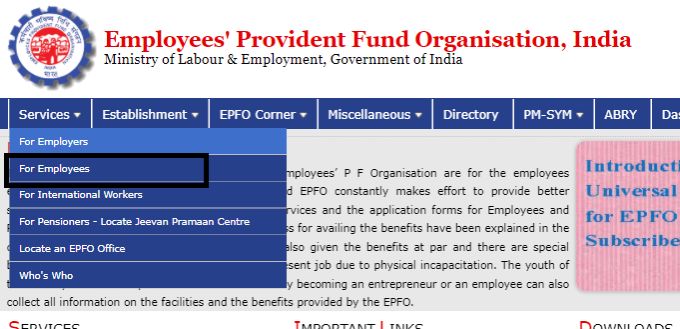

- Once it opens, click on ‘For Employees’ from the ‘Our Services’ drop-down menu.

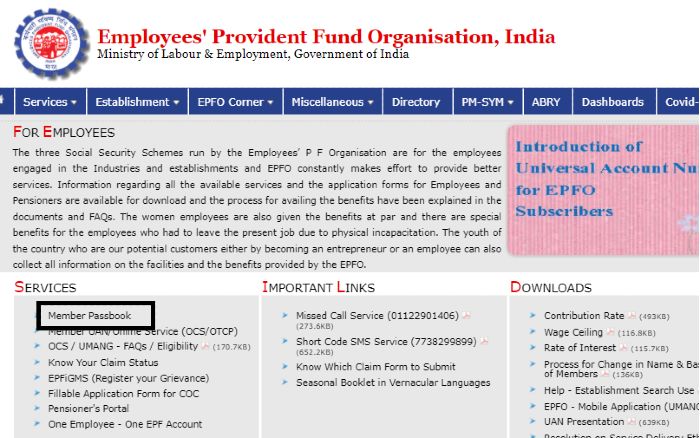

- Now, from the ‘Services’ menu, click on ‘Member Passbook’. You will then be redirected to the login page. You can, alternatively, directly visit the page.

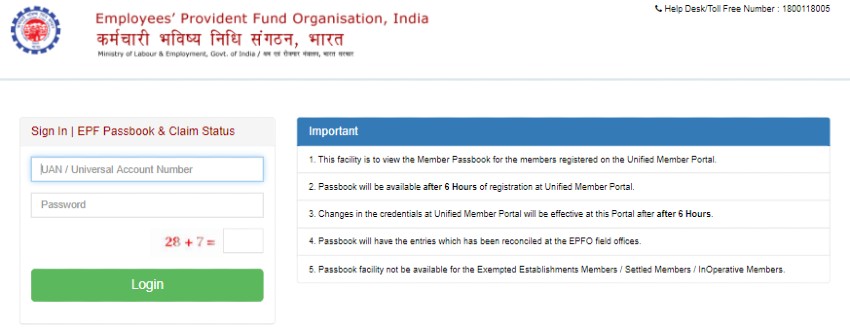

- Log in with your UAN and Password.

- You’ll find Member IDs of all the accounts linked with your UAN.

- Click on the Member ID of the EPF account for which you want to check the balance.

- The EPF passbook will then appear on the screen.

If you’re unable to view your passbook, it’s probably because you don’t fulfill the requirements. Here’s what you need to keep in mind before trying to check your EPF balance through the portal.

- Only those members who have activated their UAN and have registered on the UAN Member Portal can check their PF balance through this method.

- In case you’ve registered on the UAN Member Portal only hours ago, wait some time as the facility of viewing the passbook will be available only after 6 hours of registration.

- If you have made some changes on the UAN Portal, the same will reflect on the website after 6 hours.

- The passbook will show the latest entries that have been reconciled by the EPFO Field Offices.

- Exempted Establishments Members, Settled Members, and members of inoperative accounts will not be able to view their passbook on the EPFO website.

- Your account will become inoperative if you have stopped contributing to your EPF account for more than 3 years.

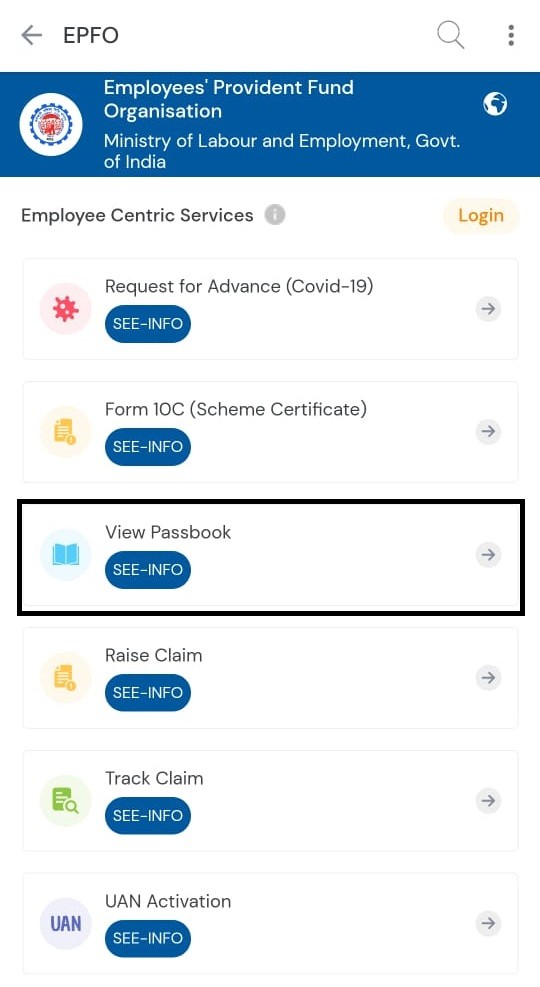

Checking your PF Balance through Umang App:

For checking your EPF balance through the Umang App, which is the government’s official website, follow these steps:

- First, you need to install the application. It’s available on both the Play Store and App Store.

- When you open the app on your smartphone for the first time, you’ll need to choose your preferred language. Also, read the terms and conditions of the “End to End License Agreement”.

- Now, get your mobile number verified, and register.

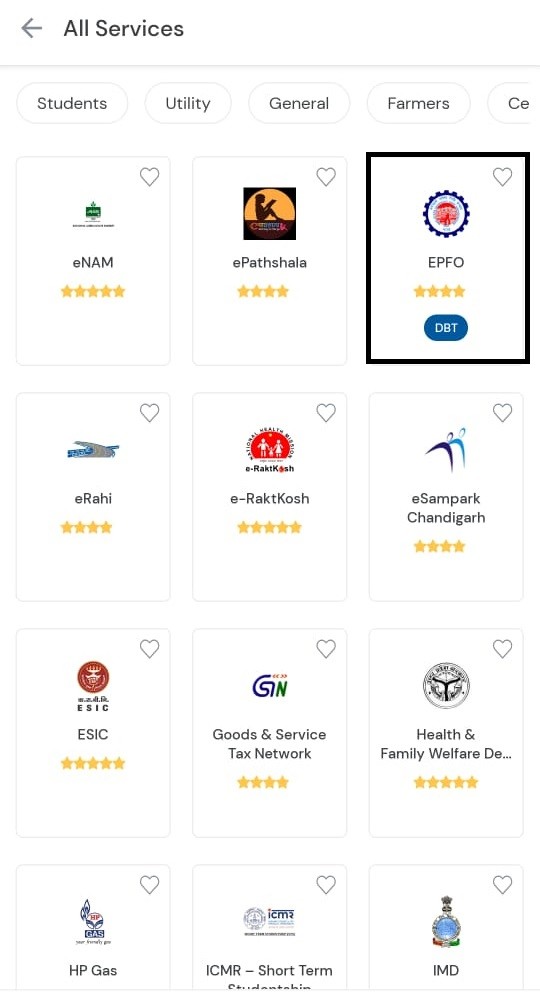

- Click on the ‘All Services’ option available at the bottom.

- Find and select ‘EPFO’ from the list of options.

- Click on ‘View Passbook‘ to check your EPF balance.

- Enter your UAN and click on ‘Get OTP’. Enter the same and hit ‘Login’.

- Your passbook will then be displayed on the screen along with your EPF balance.

What is EPF and why should you invest in it?

Working in a corporate environment is consuming. After slogging five days a week, it’s only right that you relax and spend quality time with friends and family. This, however, implies that you have very little time to ponder important decisions that might affect your future. From a financial perspective, it’s not at all ideal as investments are key to your dream life. If you don’t have time to figure out which schemes are worth the deal, you’re essentially preparing yourself for years of regret.

The Employees’ Provident Fund (EPF), which is sometimes also called Provident Fund (PF), solves that problem to an extent. Unlike other types of investment schemes, you don’t have to spend hours researching what sort of returns you’re getting, whether your portfolio is up to the mark, or whether it’s time to cash in.

Employees’ Provident Fund (EPF) is a simple scheme, wherein an amount equivalent to 12% of your salary is deducted every month as a contribution to PF, with your employer also contributing the same amount. This keeps building up and you’re also paid on a monthly basis. By the time you retire, it reaches a considerable level which you can then use for anything.

Also check

EPF India: EPF Eligibility, Interest Rate, Contribution, And Payment

EPF Interest Rate

How to Transfer EPF Online?