An income certificate is a document that certifies an individual or a family’s annual earnings from all sources. The document is sometimes also called an ‘Economically Weaker Section (EWS) Certificate’, as it can be used by low-earning individuals or families to avail themselves several government benefits.

How to apply for an Income Certificate Online?

Here’s the step-by-step guide procedure for applying for an income certificate online:

- Go to the official website/portal of your state/district/Union Territory (UT).

- Create an account on the portal using your mobile number. Choose a unique username and password.

- Use those credentials to log in to your newly created account. Now click on the link that reads “Apply for income certificate”.

- You will be redirected to the online application page, where your personal details will be required. Here’s a definitive list of details that you’ll need:

- Name

- Age or Date of Birth

- Postal address, consistent with the one mentioned in your proof of address.

- Gender

- Ration card/voter ID/driving license details

- Aadhaar card. This is mandatory in most states and UTs.

- Religion

- Caste and sub-caste (OBC/SC/ST)

- Income details consistent with Income-tax return, salary certificate, Form 16 by the employer or other proofs of income.

- After having entered all this, you will be directed to a page where you’ll need to upload relevant documents. You’ll need to upload proof of address, income and other documents as deemed necessary.

- Hit ‘Save’.

- It is now time to make the payment. Choose your preferred and make the statutory payment

- An acknowledgement slip, along with an acknowledgement number, will be generated and you can use it to track your application.

How to apply for an Income Certificate Offline?

Despite the ease of use of online applications, some people consider the offline mode of operation to be more convenient. If you want to apply for an income certificate offline, you must contact the relevant authorities in your city. You may apply to one of the following service providers:

- Tehsildar Office

- SDM Office

- Collector Office

- CSC (Citizen Service Centers)

- Revenue Office

- District Magistrate Office

- BDO Office

How to Track Online Application Status?

Checkout how to track your online income certificate application using your acknowledgment number:

- Again, you need to visit the official online portal of your state/district/UTs.

- Use your username and password to login into your account.

- Now click on the ‘Get Status’ tab.

- This is where you’ll be asked to enter the application number/acknowledgement number printed on your acknowledgement slip.

- Enter that and click ‘submit’.

- The status of your application will then be displayed.

Uses of Income Certificate

As alluded to earlier, an income certificate allows access to various government benefits and schemes. Some of the most important uses of the certificate are:

- Many educational institutions have a certain number of seats reserved for people from economically poorer backgrounds. So, having an income certificate helps secure admission to an institute and the fees are either waived off partly or entirely.

- Many scholarships are exclusively offered by some institutions/governments are specially meant for kids from a poor background. An income certificate helps avail the benefits of this scheme.

- The certificate also assists in availing medical benefits, such as free or concessional treatment, subsidized medicines, financial assistance to mothers who give birth to girl children, and so on.

- An income certificate can be used to get cheaper loans from respective government employers.

- When providing relief to victims of various natural calamities and disasters, the government first helps those having an income or EWS certificate.

- Widows can, meanwhile, use the certificate to claim government pension, if applicable.

- Lastly, it can be used to claim entitlement to hostels, flats or other such government accommodation.

List of Government websites where you can apply for a certificate online:

| Sr. No. | State | Online Portal | |

| 1 | Andhra Pradesh | Official Portal of Andhra Pradesh | |

| 2 | Arunachal Pradesh | e-Services Portal of Arunachal Pradesh | |

| 2 | Assam | e-District Services Portal of Assam | |

| 3 | Bihar | RTPS Portal of Bihar | |

| 4 | Chhattisgarh | e-district Portal of Chhattisgarh | |

| 5 | Goa | Online Portal of Goa | |

| 6 | Gujarat | Digital Gujarat Portal of Gujarat | |

| 7 | Haryana | e-Disha Portal of Haryana | |

| 8 | Himachal Pradesh | e-District Portal of Himachal Pradesh | |

| 9 | Jharkhand | JharSewa Portal of Jharkhand | |

| 10 | Karnataka | Nadakacheri-AJSK Portal of Karnataka | |

| 11 | Kerala | Akshaya Portal of Kerala | |

| 12 | Madhya Pradesh | e-District Portal of Madhya Pradesh | |

| 13 | Maharashtra | Aaple Sarkar Portal of Maharashtra | |

| 14 | Manipur | e-District Portal of Manipur | |

| 15 | Meghalaya | e-District Portal of Meghalaya | |

| 16 | Mizoram | e-District Portal of Mizoram | |

| 17 | Nagaland | e-District Portal of Nagaland | |

| 18 | Odisha | e-District Portal of Odisha | |

| 19 | Punjab | State Portal of Punjab | |

| 20 | Rajasthan | e-Mitra Portal of Rajasthan | |

| 21 | Sikkim | e-Services Portal of Sikkim | |

| 22 | Tamil Nadu | e-Sevai Center of Tamil Nadu | |

| 23 | Telangana | MeeSeva Portal of Telangana | |

| 24 | Tripura | e-District Portal of Tripura | |

| 25 | Uttar Pradesh | e-Saathi Web Portal or e-Saathi Mobile App | |

| 26 | Uttarakhand | e-District Portal of Uttarakhand. | |

| 27 | West Bengal | e-District Portal of West Bengal | |

| 28 | Andaman and Nicobar Islands | Official Portal of Andaman & Nicobar Administration. | |

| 29 | Chandigarh | Sampark Portal of Chandigarh | |

| 30 | Dadra and Nagar Haveli | Official Portal of Dadra and Nagar Haveli Administration | |

| 31 | Daman and Diu | Official Portal of Daman and Diu Administration. | |

| 32 | Delhi | e-District Portal of Delhi. | |

| 33 | Jammu and Kashmir | Revenue Department of Jammu and Kashmir. | |

| 34 | Ladakh | Official Portal of Ladakh | |

| 35 | Lakshadweep | Official Portal of Lakshadweep | |

| 36 | Puducherry | e-District Portal of Puducherry. |

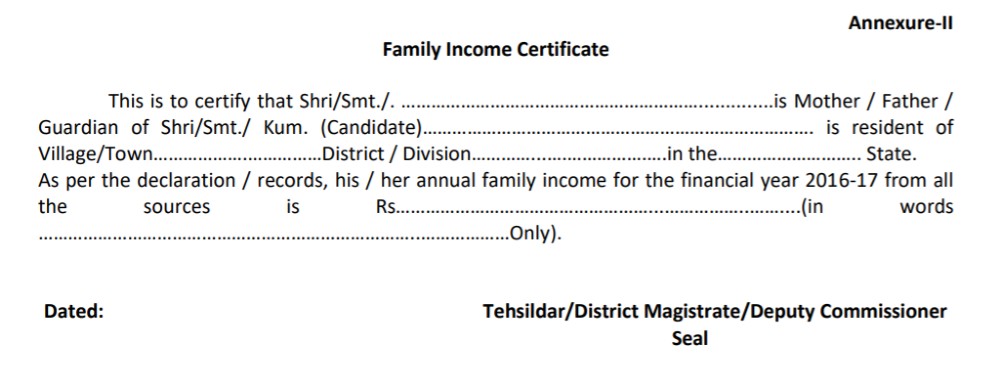

Income Certificate Sample

An example of an Income Certificate format is given below. The income certificate format can also be downloaded from the AICTE website.

Important Data on the Income Certificate Form

The primary fields included in the income certificate form, as seen in the sample above, are as follows:

- Applicant’s Name

- Name of Primary Applicant’s Parent/Guardian

- Address of the applicant, including area, district, state, and so on.

- Annual income for the applicable financial year from all the sources

- Date of Issuance of Income Certificate

- Signature and seal of the issuing State Government authority

Documents Required for Income Certificate:

The full list of documents needed to obtain the certificate can differ slightly from one state to the next. However, a few main documents remain the same regardless of the state in which the income certificate application is submitted. A short list of key documents needed for obtaining the certificate is as follows:

- Application form

- Identity proof such as:

- Aadhaar Card

- PAN Card

- Ration Card with Photo

- Voter ID Card

- Passport

- Driving License

- RSBY Card

- MGNREGA Job Card

- Identity card issued by a government or semi-government organizations

- Address Proof such as:

- Aadhaar Card

- Voter ID Card

- Driving License

- Passport

- Ration Card

- Rent Agreement (Registered )

- Bank Passbook

- Electricity Bill

- Water Bill / Telephone Bill(Landline or Postpaid)

- Gas Bill

- Land Allotment Passbook

- Age Proof such as:

- Birth Certificate

- PAN Card

- Passport

- Driving License

- School Leaving Certificate

- Bonafide Certificate

- Income Proof such as:

- IT return statement

- Salary slip

- Form 16 (if salaried)

- Certificate from BDO (for rural areas)

- Certificate from the appropriate authorities for individuals earning a living from agriculture, horticulture, or veterinary services.

- Self declaration for income certificate from the applicant

- Applicant’s 2 passport size photographs.

- Land revenue receipt (in case of farmer if available).

Aside from the documents mentioned above, the State Government or Union Territory can need additional documentation, such as expenditure evidence.

Frequently Asked Questions (FAQs):

1. What is the validity date of my salary certificate?

Ans: The certificate is only valid for the financial year in which it was issued. This means that your income certificate is valid for at most one year. That is from the beginning of the financial year on April 1 to the end of March 31 of the next calendar year.

2. Is an Aadhaar card needed to apply for an income certificate?

Ans: No, you don’t need an Aadhaar when applying for an income certificate. Any government-issued identity/address proof (including Aadhaar) can be used as supporting documentation. PAN, Voter ID, Ration Card and other government-issued ID cards are common examples.

3. I live in Delhi. Can I get an income statement in Haryana?

Ans: No, since an income certificate is issued by the state government. It can only be obtained from the government of the state in which you live. As a result, only a Haryana resident can get an income certificate in Haryana.

4. My previous application for an income certificate was rejected. Should I reapply?

Ans: The most common reasons for an income certificate application being rejected are:

- Incorrectly filling out the application

- Failing to submit supporting documentation

- Ineligibility to receive an income certificate

If your application was rejected for one of the first two reasons, you can definitely consider reapplying. But, if you are not eligible for the income statement, then applying for a new application will not be a good idea.

5. Is there a difference between an income certificate and an agricultural income certificate?

Ans: No. The income certificate contains detailed information about the annual income from all sources. While an agriculture income certificate only includes information about income from any and all agricultural activities.