Launched in 1955, the Employee Pension Scheme (EPS) is an investment tool that allows private as well as government employees to enjoy pension after retirement. The scheme is provided by the Employees’ Provident Fund Organisation (EPFO) and is especially great for investors with low or medium risk appetite.

Eligibility Criteria of Employee Pension Scheme:

To be eligible for benefits under the Employees’ Pension Scheme (EPS), you must fulfil the following criteria:

- You should be a member of EPFO

- You should have served or worked for at least 10 years

- You should be at least 58years old.

- You can also withdraw your EPS at a reduced rate once you reach the age of 50.

- You can also postpone your pension for two years i.e. up to the age of 60. After which you will receive a pension at a 4% increase for each year.

- In the event of an employee’s death while on active duty, his or her family becomes eligible for Pension payments.

How to calculate your pension under EPS?

After retirement, an employee’s monthly EPS or pension amount is determined by his or her pensionable service and pensionable salary. It is calculated using the following formula:

Employee’s Monthly Salary = (Pensionable Salary x Pensionable service) / 70

Pensionable Salary:

The pensionable salary is the average monthly income earned by the employee in the last 12 months before exiting the Employee Pension Scheme in India. Any non-contributory days in the last 12 months will not be counted, and the employee will be paid for that month.

Suppose that the monthly salary of one employee is Rs 20,000. The company contributes 8.33% of the employee’s salary to the EPS fund. Hence, the pensionable salary in this scenario is:

Monthly Pension Amount: ₹20,000 x 8.33% = ₹1,666

Annual Pension Amount: ₹1,666 x 12 = ₹19,992

If an employee does not begin work on the first of the month then his or her monthly salary will be determined based on the number of workdays rather than the number of days in the month.

If someone begins work on the 3rd of the month, the salary for the next 27 or 28 days will be decided by the amount paid per day. As a result, the monthly salary will equal the salary for the entire month for calculating EPS.

Pensionable Service:

The actual service period of an employee or worker is referred to as pensionable service. The pensionable service term is estimated by adding all the employee’s service to different employers.

Every time an employee changes jobs, he/she must get an EPS Scheme Certificate. And submit it to the new employer every time he/she changes the job.

It is important to remember that after completing 20 years of service, the employee receives a 2 year bonus.

The pensionable service duration is calculated based on a six-month period. The least term of pensionable service is six months. If the total service period is 6 years and 3 months, the pensionable service period is considered as 6 years. And if the service length is 6 years and 7 months, the pensionable service period is considered as 7 years.

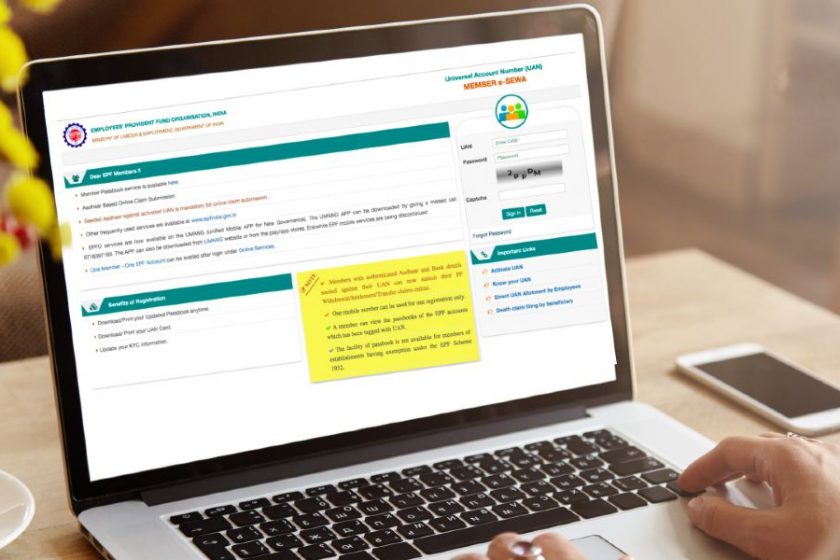

How to check your EPF Balance?

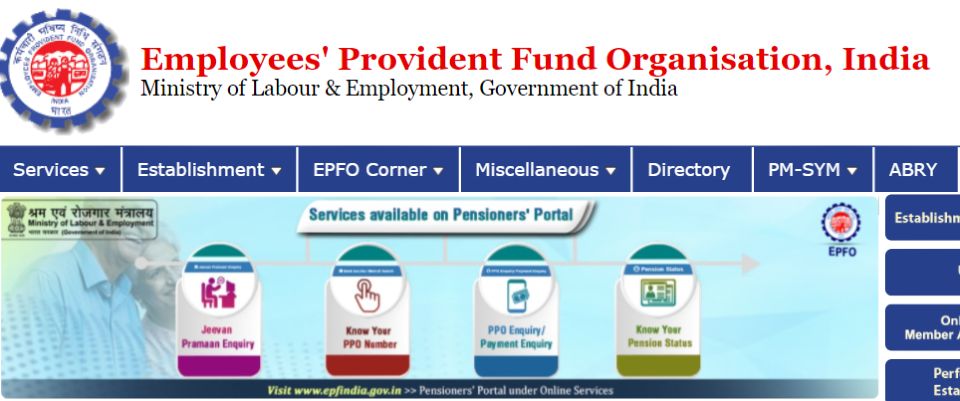

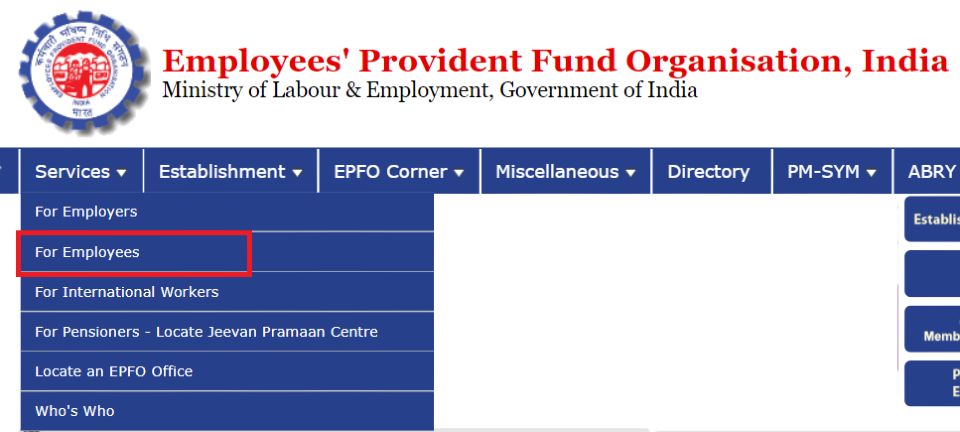

- Visit the EPFO’s official website of EPFO.

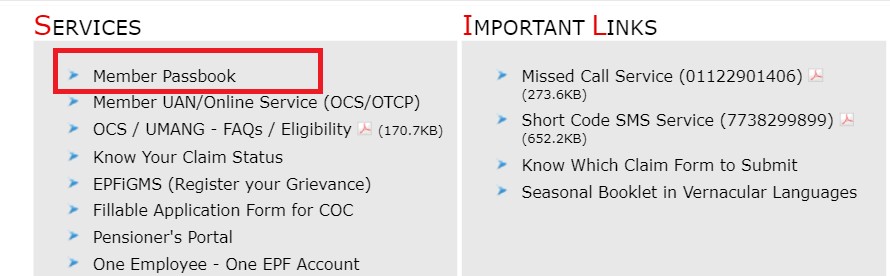

- Select “For Employees” from the “Services” dropdown option in the top left corner.

- Then, under Services, select “Member Passbook.”

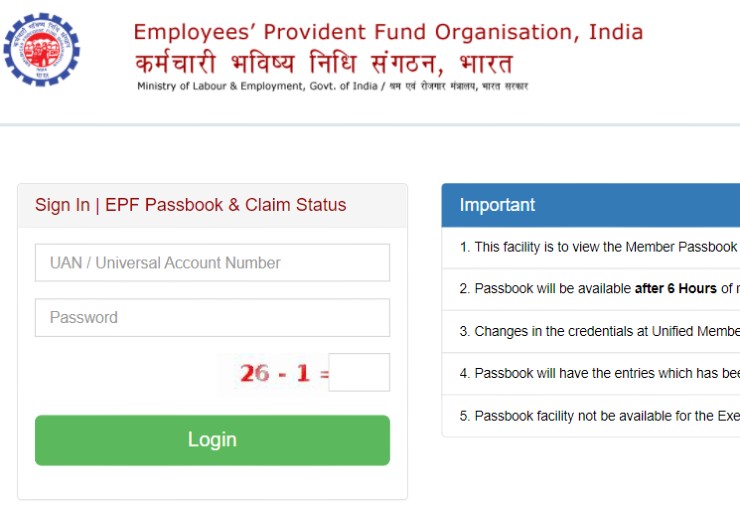

- After entering your UAN, password, and solving the captcha on the member passbook portal, click the “Login” option.

- To view all of the employer’s pension contributions to date as well as the total EPS balance, select “Select Member Id” from the dropdown and then click the “View Passbook” button on the right. By clicking on the “Obtain Passbook” button, you may also download a PDF version of the same.

Types of Pensions under Employee Pension Scheme:

Let us take a look at some types of pensions that you can earn EPS.

- Child Pension

In case the member who was receiving pension unfortunately dies, his/her children will receive the pension amount until they turn 25. The payable amount is 25% of the amount paid to widow pension. A maximum of two children can avail of the benefits of this type of pension.

- Widow Pension

This is the more common type of pension under EPS. Here, the widow of the member who was enjoying the benefits of pension will be paid the amount until her death or remarriage. The amount that she will receive is roughly the same as that her husband did.

- Orphan Pension

If the employee dies without a surviving widow, the surviving orphan children are eligible for the orphan pension. His orphan children will be eligible for a monthly orphan pension equal to 75% of his widow pension.

- Reduced Pension

In this type of pension, the member who is being paid the pension amount can withdraw an early pension. However, to do so, he must be over 50 years of age. The pension amount will be reduced depending on the number of years the said individual has left before turning 58. For instance, if he/she is 54, he/she will be 58 after 4 years. So the pension amount will be reduced by 4×4%, which equals 16%.

Benefits of Employee Pension Scheme:

The EPS is an intriguing investment vehicle that has many awesome benefits for investors. Some of them are mentioned below:

- Next to no risk

Not every investor has the capacity to ride the volatile wave of stock markets, cryptocurrencies, and mutual funds. EPS makes a lot of sense for such investors, as it comes with next to no risk. It is backed by the Government of India, which under no circumstance is going to go down. So investors’ money is always protected.

- Monthly income

Equity returns are definitely high, but there’s no guarantee that you’re going to earn a set amount of money per month. Sometimes you might earn more, sometimes you might not earn anything. EPS, meanwhile, comes with no such uncertainty. The very idea of the scheme is to ensure investors earn monthly income. Very few, if any, investment tools in the market today can offer this benefit.

- Decent returns

Investors put their money in a scheme to earn returns. If a financial tool doesn’t multiply money, it’s of no use. Fortunately, EPS offers decent returns which are comparable to some of the best schemes in today’s market.

Frequently Asked Questions (FAQs):

Here are some common queries people have regarding EPS.

Q: Can a member of the EPS change his or her nomination?

Ans: Yes, a member of the EPS can change his or her nomination. The nominee should be a family member of the employee. Only if the employee has no family, then he or she can nominate anyone else according to their wish.

Q: Under EPS, is the employee the only beneficiary of the fund?

Ans: Benefits of the EPS is paid to the employee and in his/her absence, to the family of the employee.

Q: How many years of service should a member of EPS complete in service in order to be eligible for receiving a pension?

Ans: An employee is entitled to receive a pension only after completion of a minimum of 10 years of eligible service.