The Employee Provident Fund (EPF), overseen by the Employees’ Provident Fund Organization (EPFO), is a retirement benefits scheme. 12% of an employee’s salary is deducted as contributed to PF every month, and the employer matches that contribution. Over time, this accumulates to a lot of money, which ensures peaceful retirement. While it is better to not withdraw your EPF until retirement, you can do so, either partially or completely, under certain circumstances. Read on to know how to file an EPF Withdrawal Claim.

How do you file an EPF Withdrawal Claim?

There are two ways to file a claim to withdraw money from EPF: the online process and the offline process. Let us first look at the online procedure for withdrawing PF.

How to file an EPF claim online?

Below is a step-by-step guide to filing an EPF claim online:

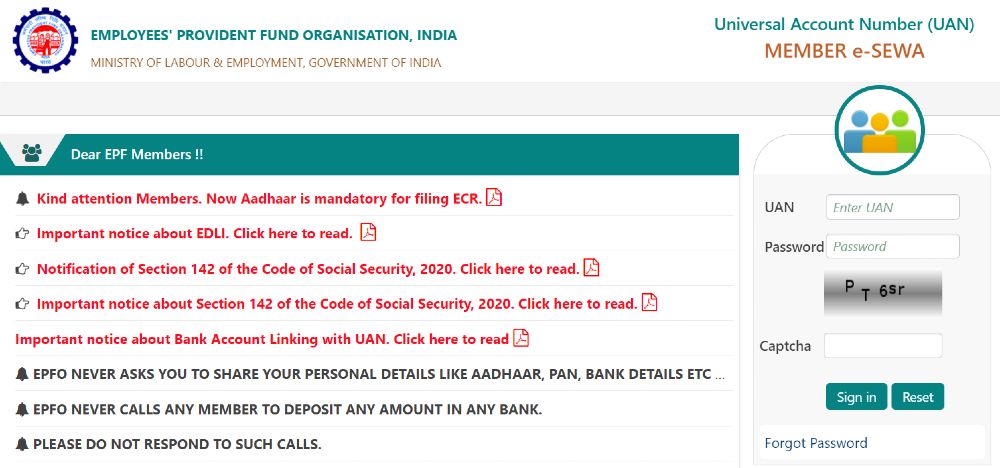

- Go to the UAN Portal.

- Now, sign in with your UAN and password, if you have it. Then, enter the captcha. If you don’t have your UAN, generate it using the link on the homepage of the UAN portal.

- Click on the ‘Manage’ tab and then select ‘KYC’ to check whether your KYC details, such as Aadhaar, PAN and the bank details are verified or not.

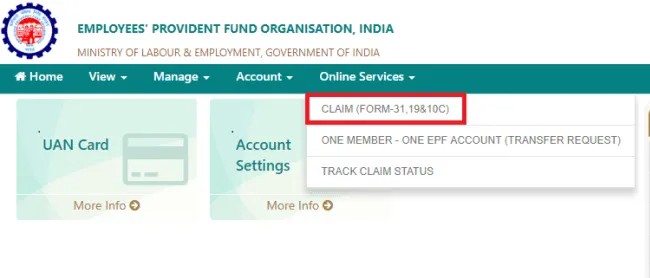

- After your KYC details are verified, go to the ‘Online Services’ tab and select the option ‘Claim (Form-31, 19 & 10C)’ from the drop-down menu.

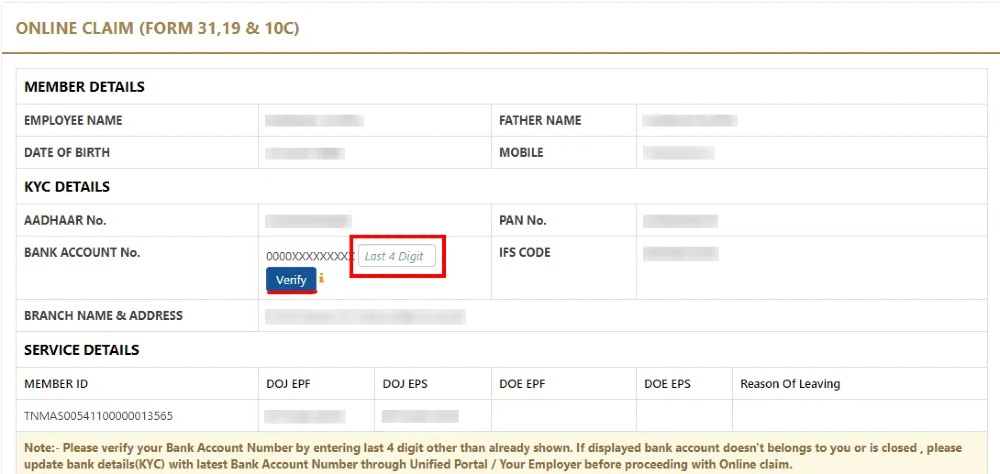

- A screen with member details, KYC details and other service details will be shown. Enter your bank account number and click on ‘Verify’.

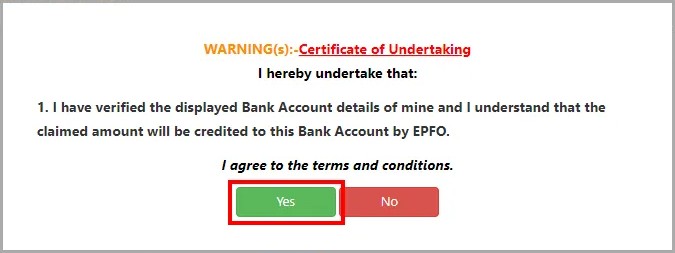

- To proceed further, click on ‘Yes’ to sign the certificate of the undertaking.

- Now, select ‘Proceed for Online Claim’.

- In the claim form, select the claim you require. Your options include: full EPF settlement, EPF part withdrawal (loan/advance) or pension withdrawal, under the tab ‘I Want To Apply For’. If the member is not eligible for any of the services like PF withdrawal or pension withdrawal, due to the service criteria, then that option will not be shown in the drop-down menu.

- Next up, select ‘PF Advance (Form 31)’ to withdraw your fund. Further, provide the purpose of such advance, the amount required and the employee’s address.

- Click on the certificate and submit your application. You may also be asked to submit scanned documents for the purpose you have filled the form. The employer will have to approve the withdrawal request and only then you will receive money in your bank account. It usually takes 15-20 days to get the money credited to the bank account.

How to file an EPF claim offline?

You can, alternatively, choose to withdraw your EPF money offline. To do that, visit the EPFO office nearest to you and submit a duly filled ‘Composite Claim Form.’ There are essentially two types of ‘Composite Claim Form’: Aadhar and Non-Aadhar. The difference between the two is that the Aadhar Form does not require attestation from the employer. The Non-Aadhar Form, meanwhile, demands that you get it attested by your employer before submitting it.

Eligibility Criteria for EPF Withdrawal

The criteria that an employee must meet in order to withdraw EPF funds are as follows:

- Only after retirement can the complete amount from the EPF account be withdrawn. Early retirement is only considered by EPFO if a person has reached the age of 55.

- Partial withdrawal of EPF is only approved in the event of a medical emergency, purchase or construction of the house, or higher education.

- One year before retirement, EPFO permits a withdrawal of 90% of the amount.

- If an employee faces unemployment due to retrenchment or lockdown before retirement, the EPF amount can be withdrawn.

- According to the new rule, after one month of unemployment, only 75% of the corpus can be removed. After employment, the rest will be transferred to the new EPF account.

- Employees need not wait for their employer’s approval for their EPF to be withdrawn. You can get the approval online by connecting UAN and Aadhaar to your EPF account.

- You must have the following things when you make the claim online:

EPF Withdrawal Limit

The maximum EPF withdrawal limit is determined by the reason for the withdrawal.

| Purpose of EPF Withdrawal | Maximum EPF Withdrawal Limit |

|---|---|

| Medical Purpose | Six times the monthly wage or entire amount whichever is lower |

| Wedding | 50% of the PF contribution |

| Home Loan Repayment | Up to 90% of the EPF amount |

| Home Renovation | 12 times your monthly salary |

| Retirement | Total EPF amount |

| Unemployment | After the first month of unemployment, 75% of the total EPF amount and rest 25% after the second month of unemployment. |

You can also read: The 5 Ways to Check EPF Claim Status

Frequently Asked Questions (FAQs):

1. What are the requirements for withdrawing EPF funds to pay down a home loan?

Ans: The primary condition for a member to withdraw EPF for house loan repayment is that he or she has worked for three years in a row. Besides, the maximum amount that can be taken out for this purpose is 90% of the EPF sum.

2. Is it possible to claim EPF without using the EPF portal?

Ans: If you don’t want to use the online platform, you can fill out the EPF withdrawal form offline. If you want to use the online option, go to the EPF member portal and log in with your UAN and password.

3. Is it possible to withdraw EPF funds without a PAN?

Ans: Without a PAN, EPF can be withdrawn. However, you will be subject to a 30% TDS deduction from the claim amount if you do so.

4. When does an EPF withdrawal become taxable?

Ans: If you remove your EPF funds before 5 years, you will be subject to a 10% TDS deduction (if you show your PAN at the time of withdrawal; if you fail to do so, then TDS to be deducted will be at 30%). If you withdraw your EPF after five years of continuous service, however, it is tax-free.

5. What is the number for the EPF withdrawal inquiry?

Ans: 1800 118 005 is the EPFO’s toll-free customer service number.

6. How do I withdraw EPF without the permission of my employer?

Ans: You do not need to seek verification from your employer if you apply for EPF withdrawal online. You must also have your PAN and Aadhaar connected to your UAN account to claim withdrawals online.