To keep receiving the Government of India’s support, businesses must pay their taxes diligently and on time. In this article, we’ll give you an insight into the process of VAT Registration and then pay Value Added Tax (VAT).

What is VAT?

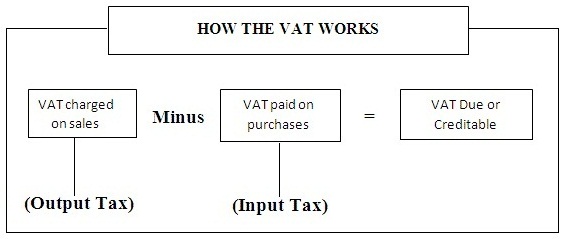

Introduced by the Central Government in the early 200s, VAT is a multi-stage tax levied on the value added to a product or service before reaching the final customers. It is collected and governed by the state governments and is mandatory for all traders, or businesses, who are involved with the manufacturing or production of goods and services.

Since it is levied by state governments, each state has its own distinct VAT rules that vary depending on the type of goods manufactured or sold. VAT seems similar to sales tax, but it is different in the sense that it is collected once at the time of purchasing.

How to register for VAT in India?

In most states, VAT registration is mandatory for traders or manufacturers that have an annual turnover of more than ₹5 lakhs. Hence, it is important for businesses of all types to be aware of the VAT registration process. Essentially, there are two ways to register for VAT in India:

- Online process

- Offline process

Online VAT Registration Procedure:

Let us first look at the online VAT registration process.

- Go to your state’s official VAT website and then click on the registration tab. (For Maharashtra you can visit https://www.mahagst.gov.in/)

- You will be asked for a whole lot of information regarding your business. Enter it correctly.

- Attach the necessary documents as a request for your company.

- The company may, then, be allotted a temporary VAT number.

- Once the verification of the documents and the VAT registration application is done, the permanent VAT registration number will be allocated to your company. This completes the online process.

Offline VAT Registration Procedure:

Here is a step-by-step guide to registering for VAT offline.

- Go to your nearest VAT office and submit an application for VAT in Form 1, along with the following documents:

- Central Sales Tax registration certificate (Form A).

- Professional tax registration certificate (Form 2).

- Copy of important documents, such as the address proof, ID proof of the Proprietor/Partner/Director.

- Four PP size photographs of the Proprietor/Partner/Director.

- PAN number and Bank Account number of the Proprietor/Partner/Director.

- Copy of the rental agreement of the business place.

- Details of business activities.

- Partnership deed (in case of a partnership firm).

- Memorandum of Association and Articles of Association (if it is a Private Limited company).

- Once you have done that, the authorities from the local VAT office will visit your premises and inspect where you conduct business within a prescribed time.

- After the inspection is over and everything seems fine to them, you will have to pay a specified fee to the local office to complete your VAT registration.

- When the fee has been paid, a TIN number will be allotted to you for your business and you will also be given the VAT registration Certificate. This completes the offline process.

How to check your VAT Registration status?

- Log in to the VAT website.

- Enter your login credentials or VAT number.

- After logging in, you can see the status of VAT and dealer.

Documents Required:

The following are the key documents that you will be needed to provide with your VAT registration:

- Certificate of Company Incorporation (in case of Companies)

- Memorandum of Association & Articles of Association (in case of Companies)

- Details about the firm’s employees.

- PAN Card of the company/Individual PAN Card (in case of proprietorship)

- Address Proof for the Company’s Director – Lease/Rental Agreement

- Identity Proof of the Company’s Director – Pan Card/ Voter ID/ Passport/ Driving License

- Lease/Rental Agreement of Company/Proprietorship

- Partnership Deed (in case of Partnership firm)

- Passport size photograph of Company’s Director

You would also need to provide:

- Name of the Dealer

- Company’s name

- Postal Address

- Telephone number

- Email id

- Details of Director/ Managing Director/ Partners / Proprietor

- Authorized Signatory’s details

- Pan number of the company

- Date of Commencement of Business

- Date of Birth/ Incorporation (in case of Company)

- Nature of Business

- Commodities description

- Bank Account details

- List of Directors (in case of Companies)

Limits and Fees on VAT Registration

The following are the details of the VAT registration threshold and the costs that you must pay:

- ₹500 – Registration fee for VAT

- Professional Tax:

- ₹.1,000 for a sole proprietorship

- ₹.1,000 for each partner of a partnership, and

- ₹.2,500 for a private limited company

- ₹.2,000 – For a turnover of ₹0 – ₹2 lakhs.

- ₹.3,000 – For a turnover of ₹2 lakhs – ₹10 lakhs.

- ₹.6,000 – For a turnover of ₹10 lakhs – ₹25 lakhs.

- ₹.10,000 – For a turnover over ₹25 lakhs.