TDS stands for Tax Deducted at Source (TDS). As the name suggests, it is the amount deducted from an individual’s salary, rent, or any other income. When this amount is more than the tax applicable for that individual, he/she needs to apply for a TDS refund.

How does one claim a TDS refund?

There’s actually no separate application form for applying for a TDS refund.

- The taxpayer has to simply visit the IT department’s website (https://incometaxindiaefiling.gov.in/). There he/she must register themselves. Once that’s done, the income tax return has to be filed. This can be done by downloading the ITR file available on the website.

- It is a fairly straightforward form that requires a few details. After filling them in, the form has to be uploaded and then submitted on the site.

- An acknowledgement will be generated, which then has to be e-verified. It can be done through a digital signature, an Aadhaar-based OTP or through a net banking account. If none of those work for some reason, a physical copy of the same must be sent to the IT department.

- After everything’s in place, the software will recognise and display whether TDS is refundable to the taxpayer or not. If it is, the amount will be credited to the taxpayer. While it can take a few months for that to happen, the taxpayer will earn interest @6% per annum.

How to Check TDS Refund?

The procedure for checking the status of a TDS refund is straightforward and can be checked from either of the following:

- On the e-filing portal of the IT Department or

- On the NSDL website

Checking status of TDS Refund on an E-Filing Portal: A Step-by-Step Guide

Step 1: Go to the Income Tax Department’s e-filing portal by clicking here.

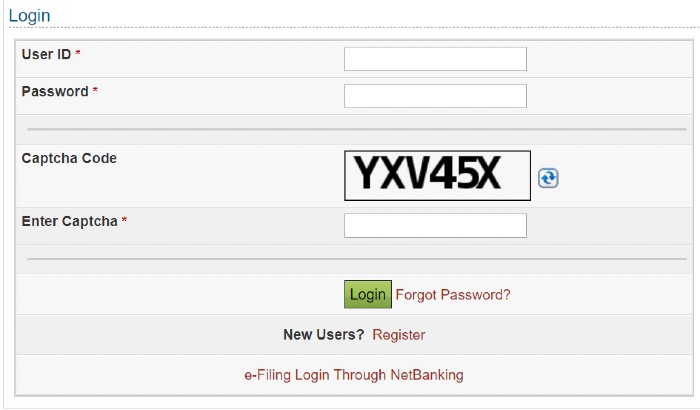

Step 2: Login into your account by entering the required details as shown below:

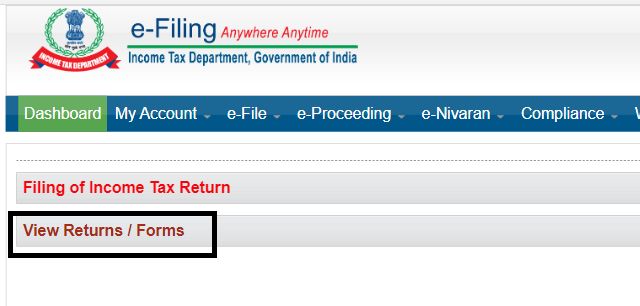

Step 3: Choose View Returns/ Forms as shown:

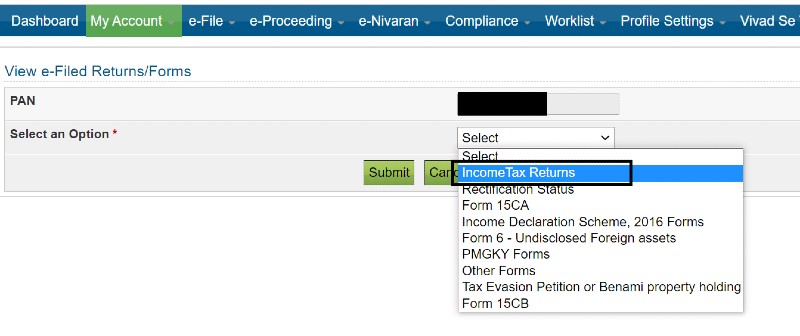

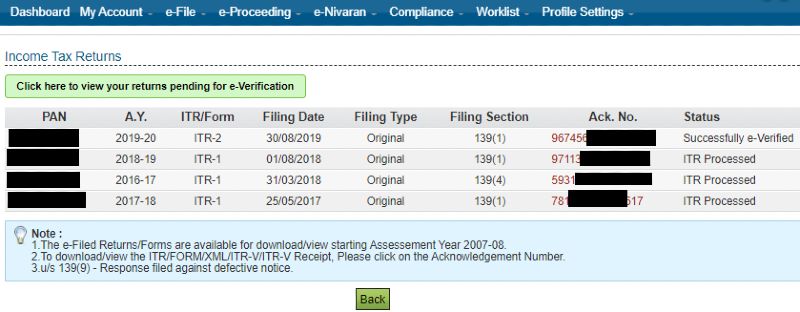

Step 4: Choose ‘Income Tax Returns‘ from the ‘My Account’ tab. Submit the form.

Step 5: Choose the acknowledgement number as shown:

Step 6: A tab will appear with your TDS Return information and the status of your tax refund.

Checking Refund Status on the NSDL Website: A Step-by-Step Guide

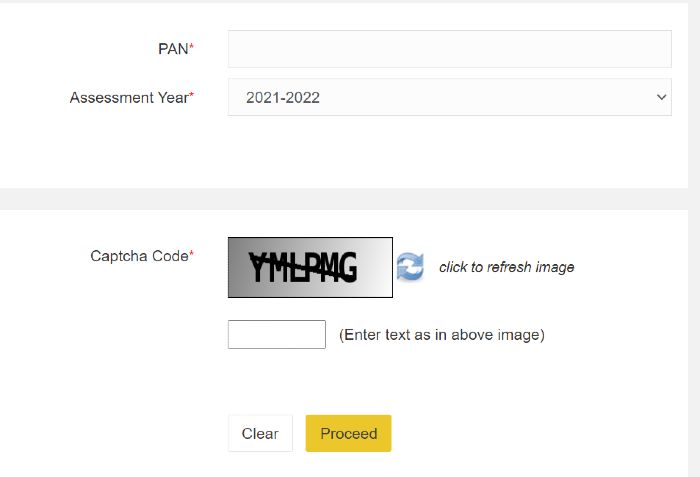

Step 1: To check your refund, go to the NSDL portal.

Step 2: A new window will open, displaying the following webpage. Fill in the required information, like PAN (Permanent Account Number) and Assessment Year, and then press ‘Proceed.’

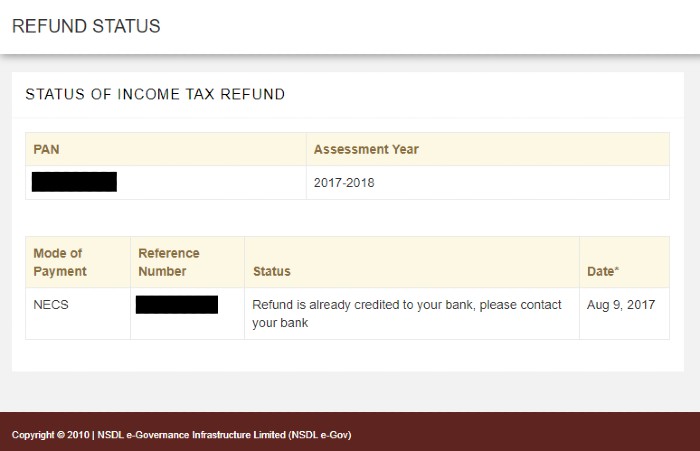

Step 3: The status of your tax refund will be shown, as seen in the image below.

What is a TDS refund?

A taxpayer applies for a TDS refund when he/she ends up paying more tax than applicable. Certain employers and companies deduct a set percentage of TDS without actually checking if that individual indeed falls under that tax bracket. Let us understand this further by example.

Say the Total Tax payable by person A for a financial year is ₹50000. Now, a certain company that offered a project to person A deducted TDS of ₹30000 while making the payment. Person A’s employer also deducted a TDS of ₹25000. What this means is that person A has paid more tax than is applicable. So, he is eligible to apply for a TDS refund. Through it, he’ll receive ₹5000, which is the extra amount he paid.

FAQs

Here’s a list of common queries people have with regards to TDS and TDS refund:

- Who must deduct the Tax deducted at Source (TDS)?

Ans: The following people/entities can deduct TDS:

- Self Employed Individual, HUF or Sole Proprietor when he/she is carrying on a business, whose turnover is more than ₹2 crore in the previous year.

OR

- Self Employed Individual, HUF or Sole Proprietor when he/she is carrying on a profession and the turnover is more than ₹50 lacs in the previous year, or Company or Partnership Firm or Association of Persons or Body of Individuals.

- What are the prerequisites for deducting TDS?

Ans: A customer must have obtained a Tax Deduction Account number (TAN) before they deduct TDS. It is required for deposition of any TDS deducted.

- Does the request need to be made for the due refund along with the submission of TDS certificates?

Ans: Yes. The request needs to be made in the format attached in Annexure II. Please note: separate applications are required to be made for each financial year.