Public Provident Fund (PPF) is a popular investment instrument that works best for individuals with a low-risk appetite. It was introduced all the way back in 1968 in an attempt to help people build a substantial retirement corpus, whilst saving tax at the same time. The biggest benefit of investing in PPF is that it offers guaranteed returns, since it is regulated by the Government of India.

Does PPF offer interest?

Yes! Like every other investment vehicle, PPF also offers a return on investment. The interest rate of a PPF scheme is determined by the Finance Ministry, and it keeps changing on a quarterly basis. For the October to December quarter of Financial Year 2020-21, the interest rate of PPF has been fixed at 7.1%. The government pays this amount every quarter.

What are some of its key features & benefits?

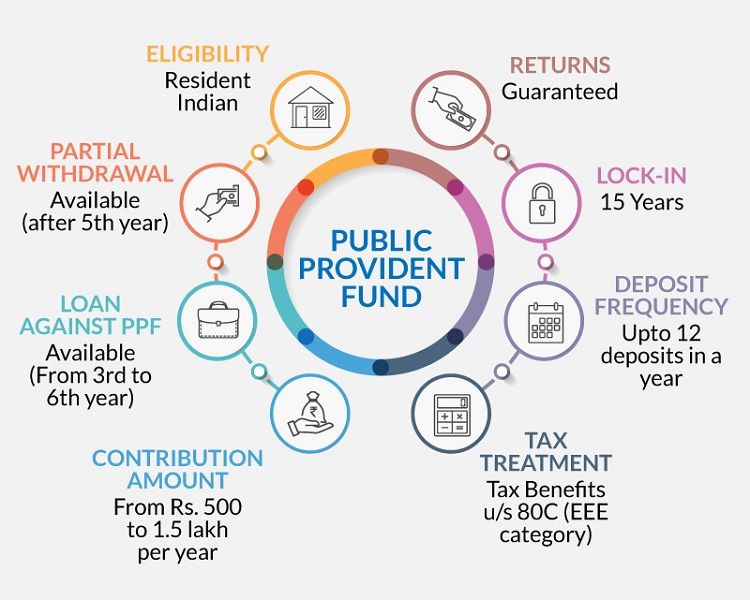

The standout features of PPF include:

- Principal amount

You cannot invest as much as you want in PPF. The upper limit to investing in PPF is ₹1.5 lakh for each financial year. The lower limit is similarly fixed at ₹500. You have the option to invest on a lump sum or installment basis. Not more than 12 installments are, however, accepted if you choose the latter.

- Tenure

The lock-in period of PPF is a unique feature that you won’t find in any other investment vehicle. It is fixed at 15 years, and you cannot completely remove your funds before that duration. Partial withdrawal is allowed but you can only do so after five years. The amount, meanwhile, is capped at either 50% of the balance at the end of the fourth financial year, or 50% of the balance at the end of the preceding year.

- Loan against PPF investment

This is another great thing about investing in PPF. You can take a loan against your investment in PPF, starting from the beginning of the 3rd financial year till the end of the 6th year. Furthermore, you can take a loan only against 25% or less of the total amount present in the PPF account. The tenure of the loan cannot exceed 36 months. You can also take a second loan before the end of the 6th year if you have repaid the first loan in full.

- Taxation

According to the Income Tax Act of 1961, PPF, as an investment scheme, comes under the Exempt-Exempt-Exempt (EEE) category of income tax. What this essentially means is that money put in PPF is exempt from tax. This includes the principal amount, maturity amount, and interest as well.

- Opening balance

While the lower limit of investing in PPF is fixed at ₹500 on a monthly basis, you can open a PPF account with as little as ₹100.

- Risk factor

Any investment scheme basically comes due to its risk factor, and this is where PPF beats all its competitors. Being backed by the Government of India guards investors’ money, meaning all your money invested in a PPF account is 100% safe. You’ll receive guaranteed returns, which are essentially paid by the Finance Ministry. This is a striking feature as most other types of investments come with significant risk factors.

Is there an eligibility criteria?

Yes, not everyone can invest in PPF. To be eligible for investing in PPF, you must fulfill the following considerations.

- You must be a citizen of India. The scheme is also for Indian residents.

- You must not be a Non-Resident Indian (NRI). If so, you won’t be allowed to open a PPF account. However, in case you had an existing account, you can operate it for the remainder of the tenure.

- You can be minor, although the account should be operated for a parent or guardian.

- You should not have another PPF account. One individual is allowed to operate only one PPF account. Joint accounts are also not allowed when investing in PPF.

Step-By-Step Process to Apply for PPF for Investing:

For investing in PPF, you first need a PPF account. If you’re eligible, you can do so either offline or online. You’ll need to visit the nearest branch, or the website, or a post office, a national bank like State Bank of India (SBI), or a private player like ICICI Bank and HDFC Bank. All these institutions have been granted permission to open a PPF account.

While every bank has its own procedure for opening a PPF account online, the steps for doing so are pretty much the same everywhere. Here’s a guide that will prove useful if you’re looking to open a PPF account online.

- Log in to the net banking portal. This implies that you need an account in the bank if you want to open a PPF account using their portal.

- Click on the option that says ‘Open a PPF Account’. You can use the search tool to do this.

- Choose either ‘self account’ or ‘minor account’.

- Enter the relevant details, and then verify it. This includes your PAN.

- Now enter the amount you wish to deposit in the PPF account.

- Select the auto-debit feature if you want the money to be automatically deducted from your account every month.

- Verify the One-time Password (OTP) sent on your registered number.

- This completes the PPF account opening procedure.

Depending on the bank, you might be asked to submit a hard copy of the same, along with your relevant papers and reference number, to the nearest branch. After you’ve opened a PPF account, you’ll be given a passbook which looks pretty like a bank passbook. It will help you track each transaction in your PPF account.

Does opening a PPF account require certain documents?

Yes, absolutely. There’s a whole list of paperwork that will be needed when you go ahead and open a PPF account. These include:

- Know Your Customer (KYC) documents, like Aadhar Card, Voter ID, and Driving License. This will help the institution confirm your identity.

- Form A, which is a PPF account opening form. You can get it at a private or nationalized bank, or at the post office.

- Address Proof.

- PAN Card

- Passport-size photograph

- Form E, which will help you declare a nominee.

Does opening a PPF account require certain documents?

Yes, absolutely. There’s a whole list of paperwork that will be needed when you go ahead and open a PPF account. These include:

- Know Your Customer (KYC) documents, like Aadhar Card, Voter ID, and Driving License. This will help the institution confirm your identity.

- Form A, which is a PPF account opening form. You can get it at a private or nationalized bank, or at the post office.

- Address Proof.

- PAN Card

- Passport-size photograph

- Form E, which will help you declare a nominee.