If you are an NRI (Non-Resident Indian) and have taxable income in India or plan to invest or conduct financial transactions in India, you may need to apply for a PAN (Permanent Account Number) card. In this guide, we will take you through the step-by-step process of applying for an NRI PAN card.

Whether you are a first-time applicant or need to update your existing PAN card, we have got you covered. So, let’s dive in and explore how to apply for an NRI PAN card.

What is a PAN Card?

A PAN(Permanent Account Number) is a way for the taxpayers of the country to Identify themself. It contains a 10-digit unique identification number containing both alphabets and numbers, which are assigned to people with Indian citizenship by the Indian Income Tax Department, mostly to those who pay taxes and file for income tax returns.

Why Do I Need A PAN Card If I Am An NRI?

Over the past century, many Indians have migrated to different parts of the world in search of better opportunities. Lately, people of Indian origin or NRIs are all over the place, showcasing their talents and adding to the worldwide economy’s expansion. While Indian residents are required to have a PAN card for tax purposes, yet, as an NRI you would need a PAN if you:

- Have any taxable income in India

- Plan to make any financial transactions in India

- Want to invest in the stock market of India

- Want to Invest in mutual funds

- Want to buy or sell property

- Wish to open a bank account

- Wish to start a business in India

How To Apply For NRI PAN Card?

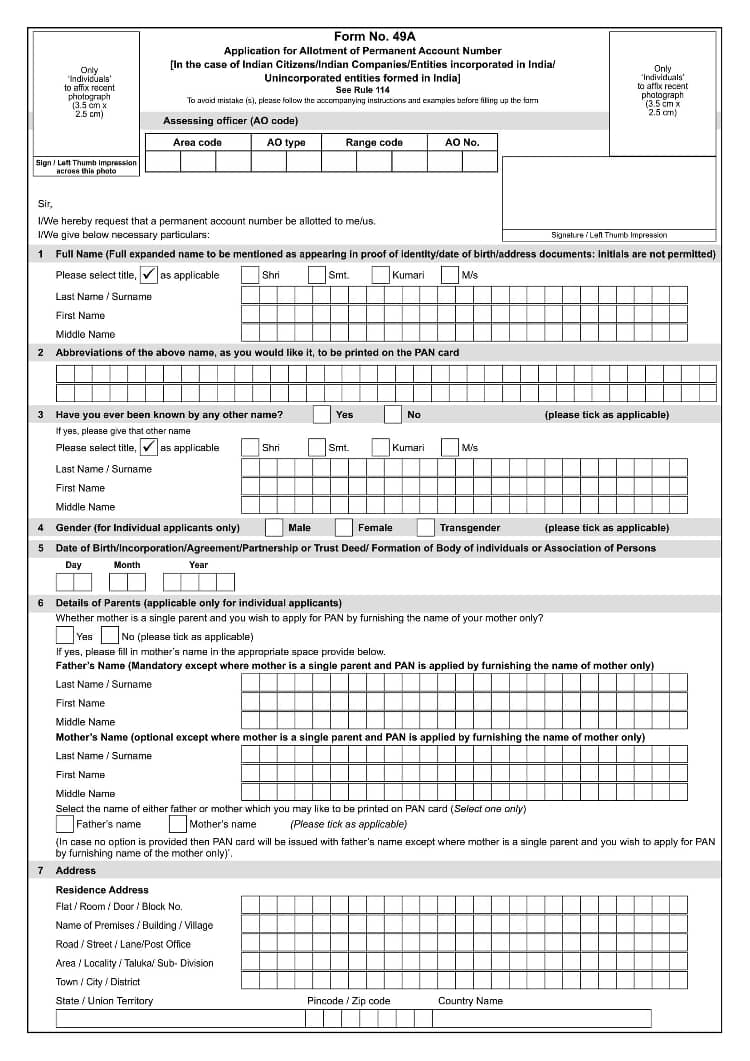

You can apply for a PAN by submitting Form No. 49AA to the PAN application centre of UTIITSL or Protean (formerly NSDL eGov), together with the necessary paperwork and fees. The Income Tax Department has made it easy to get an NRI PAN Card, so you don’t have to stress about it. Here are the steps to follow:

- Go to the official TIN-NSDL website.

- For NRI, use Form 49AA and provide all the necessary info.

- Submit the form with all the required documents as listed below.

- Pay a fee of Rs 107 (if you’re giving an Indian address) or Rs 994 (if the address is outside India).

- Once you’ve paid, you’ll get an acknowledgement number that you can use to check on the status of your application.

Step-By-Step Process To Apply For An NRI PAN Card Online:

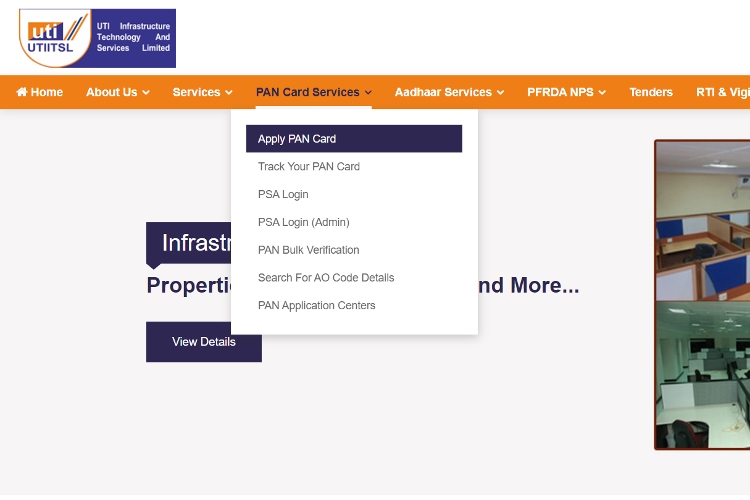

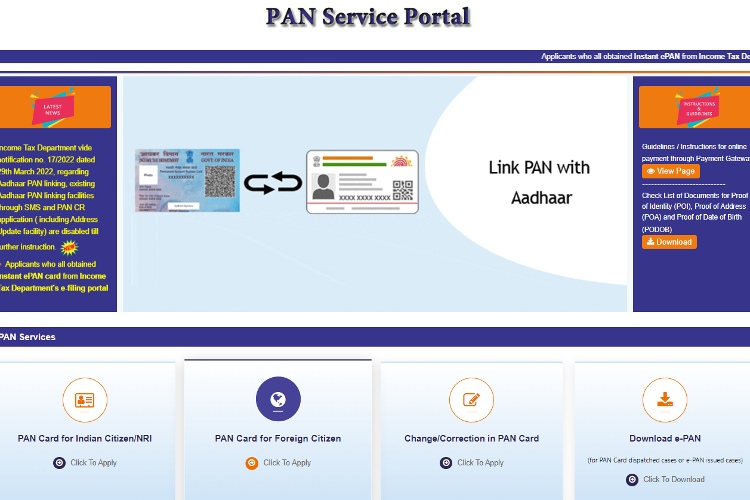

- Go to the UTIITSL or Protean website and click on “PAN Card Services”. Then select “Apply for PAN Card”.

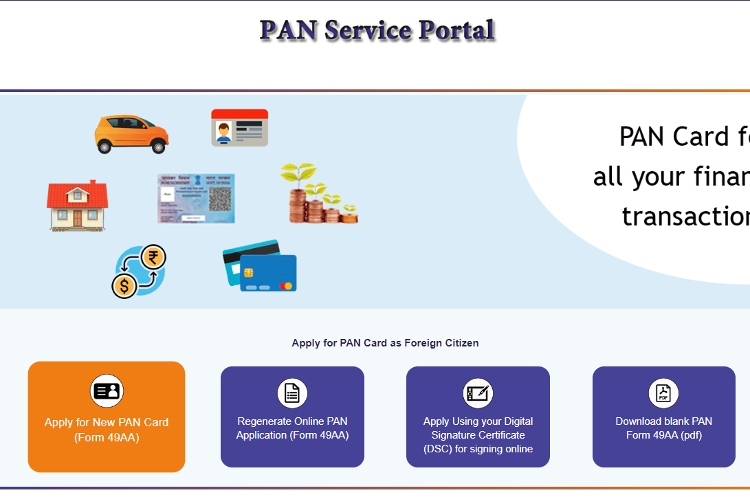

- A new PAN Service Portal will open up in a new tab. Click on “PAN Card for Foreign Citizen”.

- Next, you’ll see another tab where you have to choose “Apply for a new PAN card (Form 49AA)”.

- Read the instructions carefully from the guidelines and instructions page.

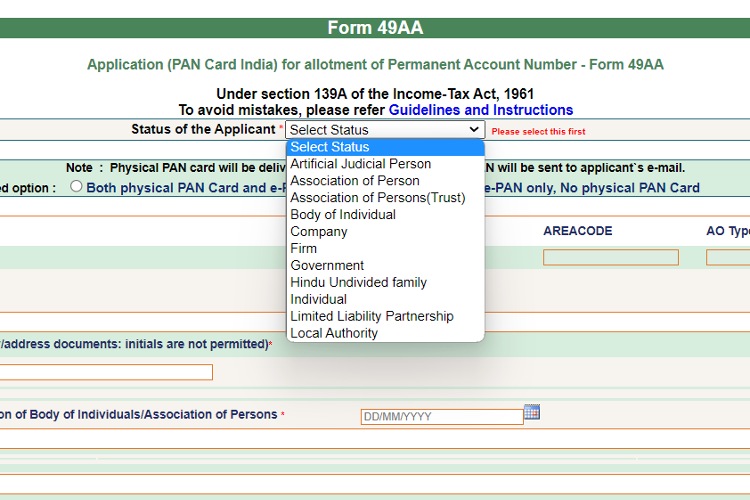

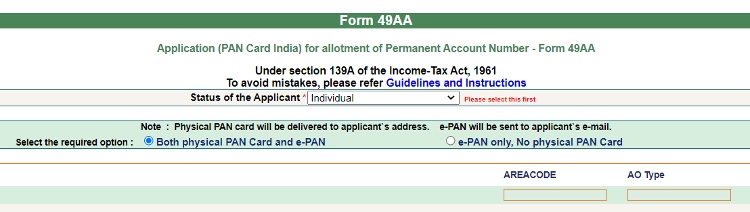

- An online form will open in a new tab. Select the type of applicant from the drop-down menu, at the top of the page.

- Choose to receive both physical and digital(ePAN) copies of the PAN.

- Fill in all the necessary details, following the instructions provided.

- Review the information you’ve provided and upload the required documents.

- Click on “Submit” after reviewing everything.

- After submitting, you will be redirected to the payment gateway for processing fees. You can pay this fee online using a credit card or choose to pay by cheque/DD from an Indian bank.

- Once you’ve submitted the application, an acknowledgement will appear on the screen.

- Print out the acknowledgement and stick two photos in the spaces provided. Sign it and attach the documents if you haven’t uploaded copies of them.

- If you’ve chosen to pay by cheque/DD, attach it and post the acknowledgement and other documents to the address printed on the acknowledgement.

- You will receive a PAN from the Income Tax Department of India will send you the PAN by post to the address you’ve mentioned in the form within 21 working days from the date of receiving the acknowledgement.

Step-By-Step Process To Apply For An NRI PAN Card Offline:

If you’re an NRI and can’t apply for a PAN card online, don’t worry! You can still get it done offline by following these simple steps:

- To get the application form, you can drop by your nearby IT PAN service centre or TIN facilitation centres such as UTI and NSDL.

- Fill in the form, attach relevant document copies, provide your signature and submit it.

- Once you complete the process, you’ll receive an acknowledgement slip. And remember, you can pay the NRI PAN card fees via demand draft.

Documents Required To Apply For An NRI PAN Card:

Now, let’s talk about the documents you’ll need to apply for an NRI PAN card. The required documents may vary based on whether you have Indian citizenship or not.

For NRIs with Indian citizenship, the basic documents required are:

- Proof of Identification: Voter ID, Aadhaar card or Driving License.

- Address proof like a copy of passport, bank account statement from the resident country or NRE bank account statement copy showing at least two transactions in the past six months.

- Two recent passport-size photographs.

- Copy of PIO or OCI card.

Foreign citizens who want a PAN card with an Indian office address also need to submit the above documents along with Form 49AA. Additionally, they need to provide:

- A copy of the appointment letter issued by the Indian office.

- An authorized copy of the original address certificate issued by their Indian employer.

- PAN card details of the employer for online verification.

Finally, if you’re paying the PAN application fee through offline mode like a demand draft, make sure to attach it during the application process.

What Is The Payment Procedure For An NRI PAN Card?

If your communication address is in India, you’ll need to pay a registration fee of Rs.110. You can pay this fee through credit card, debit card, net banking, or demand draft.

If the communication address you have provided is abroad, then you will have to pay a total of Rs.1,020 as a registration fee. You can pay either through your debit card or by demand draft. If you decide to pay by demand draft, then it will be required to be drawn in the favour of Protean eGov Technologies Limited-PAN payable at Mumbai.

Note: Foreign credit cards are not currently accepted to make payments.

Contact Details of PAN Card Office

Protean eGov Technologies Limited TIN Head Office Times Tower, 1st Floor, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel, Mumbai, Maharashtra, PIN – 400013.

PAN/TDS Call Centre of Tax Information Network (TIN) managed by Protean eGov Technologies Limited 4th Floor, Mantri Sterling, Plot No. 341, Survey No. 997 /8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016.

Phone number – 020 – 27218080 Email ID – [email protected]

Do’s and Don’ts of Filling a PAN Application Form

Do’s:

- Please use capital letters and black ink to fill out the application form.

- The signature should be within the box only.

- Provide the correct AO code.

- Provide correct proof of address and proof of identity.

- It’s important to make sure that your name and other details on your proof of identity match the information on your proof of address, as this is crucial.

- In case the applicant is a minor, a legal representative of the applicant needs to provide proof of identity and proof of address.

Don’ts:

- Do not overwrite in the application form. Be careful while providing your details.

- Do not pin or staple the photograph to the application form. Use an adhesive instead

- Do not write the date or place it below your signatures.

- Do not mention your husband’s name in the ‘Name of the Father’ column.

- Do not apply for PAN Card, if you already have one.

Frequently Asked Questions (FAQs):

1. Is it Mandatory for an NRI to have a PAN?

Not all NRIs are required to have a PAN, but those who earn money in India must have a PAN to pay their taxes. This income could come from renting out a property, getting profits from shares, or returns from mutual funds. NRIs who don’t earn any money in India don’t need a PAN, but it’s recommended to apply for one and keep it safe for future needs.

2. What are the Benefits of PAN to NRIs?

A PAN is an essential ID in India that serves many purposes, such as:

- Making it easier to pay taxes as it’s compulsory for all taxpayers.

- NRIs can’t invest in mutual funds or securities without a PAN.

- Buying property or vehicles in India requires a PAN.

- Depositing large amounts of money also needs a PAN.

- Having a PAN makes the KYC process simpler in most banks.

3. How long does it take to get a NRI PAN card?

As an NRI, you can expect to receive your PAN in about 15-20 days after submitting all documents and paying the fee. The PAN card will be sent to the communication address mentioned in your application.

Important Points to Note:

- If you have provided an overseas address, please check if Protean eGov Technologies Limited posts PAN cards to the country you reside in. At present, Protean eGov Technologies Limited sends PAN cards by post to 99 countries.

- Make sure to send the acknowledgement to Protean eGov Technologies Limited within 15 days from the date you filled in the online form.