Launched at the start of May 2015 by Prime Minister Narendra Modi, the Atal Pension Yojana (APY) is a government-backed scheme that works just like any other pension scheme. The main objective of the scheme is to allow citizens from the unorganized sector, like delivery boys, house helpers, and gardeners, to earn a pension after retirement. That, however, doesn’t mean that individuals working in the organized sector cannot avail the benefits of the scheme.

The APY is registered with the National Pension Scheme (NPS) and is administered by the Pension Fund Regulatory and Development Authority of India. Citizens who opened an account between 1 June 2015 and 1 December 2015 were awarded special benefits, as they earned a co-contribution amount of 50% of their invested amount or ₹1000/year, whichever is lower, from the Indian government for a period of 5 years.

What are the key features of the Atal Pension Yojana?

The APY comes with a wide range of attractive features that work well for low to middle-income individuals. Some of the top ones are:

- Tax exemptions

Contributions made towards the APY are eligible for tax exemptions under Section 80CCD of the Income Tax Act, 1961. A maximum of 10% of an individual’s gross total income, up to a limit of ₹1,50,000, is exempt from tax, while an additional exemption of ₹50,000 for contributions to the Atal Pension Yojana Scheme is also allowed.

- Flexibility with the contribution amount

The APY is designed in a way to allow maximum flexibility to contributors. Hence, they are allowed to increase or decrease their contribution amount once a year.

- Age restrictions

Any citizen of India over the age of 18 and under the age of 40 can opt for the APY. The upper limit has been fixed at 40 because the scheme requires contributions for at least a period of 20 years.

- Auto debit

The APY is in line with India’s digitisation goals. Therefore, contributions are automatically transferred from an individual’s bank account to their pension account.

- Lenient withdrawal policies

The APY has flexible withdrawal policies that cover all types of situations. In case of an emergency, like a medical illness or death, the contributor, or his/her nominee, can choose to exit the scheme and take home the invested amount. After turning 60, the contributor can also decide to exit the scheme and receive monthly payments in return for the invested amount.

- Freedom to decide the pension amount

After turning 60, if the contributor decides to close the account and annuitise the invested amount, he/she has the freedom to decide the monthly pension amount they want to receive. It can be anything from ₹1,000 to ₹5,000.

What are the benefits of investing in the APY?

The APY makes a lot of sense from an investment point of view. Some of its top benefits include:

- Low-risk scheme

The backing of the Indian government makes the APY among the most secure investment schemes in the country. It isn’t dependent on the market either, which means it isn’t volatile like some of the other schemes.

- Secures your retirement

Old age is an uncertain time, and it could become even more tricky if you’re reliant on someone else. The best way to combat such a problem is to invest in a scheme that promises regular income. The APY gives you exactly that, thus guarding you against the sudden challenges of post-retirement life.

- Save tax

As already discussed, contributions made to the APY are exempt from tax under Section 80CCD of the Income Tax Act, 1961. So, if you’re looking to save more money on tax, the APY is a good option to consider.

- Works for all types of citizens

The APY is an inclusive scheme that was actually designed for individuals working in the unorganized sector. However, those in the organized sector with a low-risk appetite, can also reap the benefits of the scheme and earn pension after retirement.

- Option to choose a nominee

As a contributor towards APY, you have the choice to pick a nominee who will receive the pension in case of an untimely death. He/she can, then, choose to close the account and withdraw all the funds or receive a monthly pension.

How do you apply for the APY?

Before applying for the APY scheme, ensure that you meet the following requirements:

- You are an Indian citizen.

- You are between the ages 18 and 40.

- You have a valid bank account that is linked with your Aadhaar.

If you fulfill these requirements, follow these steps to apply for the Atal Pension scheme:

- Get yourself an atal pension yojana form for registration. You can get it online, such as on the Pension Fund Regulatory and Development Authority’s (PFRDA) official website, or at a local branch of a bank that participates in the scheme.

- Fill up the form. It has three sections, namely Section 1, Section 2, and Section 3. In the first section, you’ll need to provide basic bank details like the name of the bank, details about the branch, and your bank account number. In Section 2, you’ll be asked for your personal details such as your name, age, date of birth (DOB), email ID, mobile number, marital status, the name of your spouse (if married), name of the nominee, and your relationship with the nominee. If you’ve chosen a nominee, you’ll also need to mention their DOB and questions like ‘Is the minor a beneficiary of other statutory social security schemes?’ and ‘Is the minor an income taxpayer?’ in the latter part of the form. In Section 3, enter the pension amount you want. You can select ₹1000/₹2000/₹3000/₹4000/₹5000.

- Carefully enter all these details and double-check if you’ve done so correctly. If everything seems alright, submit the APY registration form at your local bank branch.

- Now you’ll need to provide your bank account number, Aadhar number, and mobile number.

- This completes the procedure. Your first contribution towards the pension yojana will be debited from your linked bank account at the time of account opening.

- You will be issued an acknowledgment number/PRAN number by the bank.

- If you’ve accepted the auto-debit feature, subsequent contributions will be automatically deducted from your bank account from the following month.

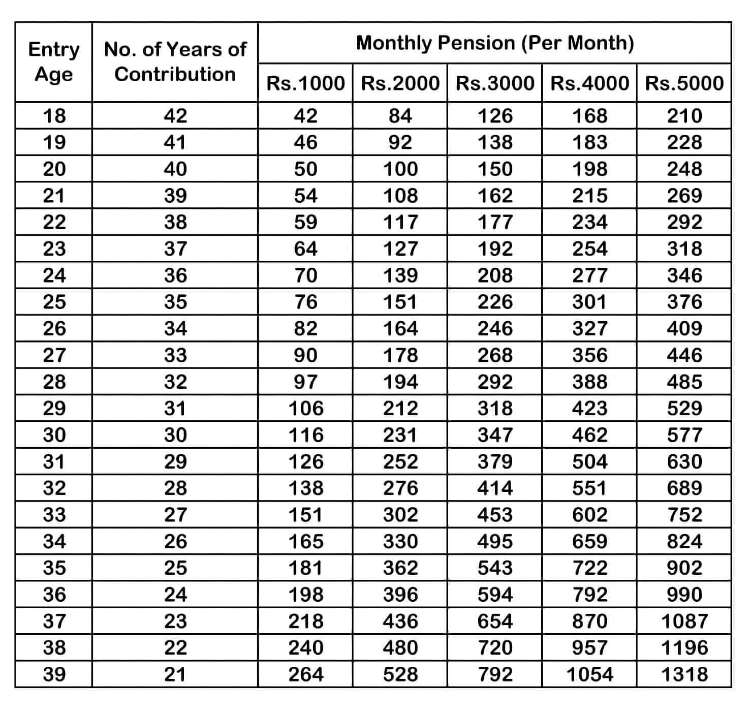

Contribution Towards Atal Pension Yojana

The monthly contribution towards the Atal Pension Yojana depends upon the amount of pension you would like to receive upon retirement and also the age at which you begin contributing. The following atal pension yojana premium chart table indicates the annual amount that a person must pay and the number of years the contribution must be paid in order to earn a pension of Rs.1,000, Rs.2,000, Rs.3,000, Rs.4,000, or Rs.5,000:

Atal Pension Yojana vs NPS

| National Pension Scheme (NPS) | Atal Pension Yojana |

|---|---|

| You can join the National Pension Scheme when you’re at least 18 years old, with a maximum entry age of 55 years. | Atal Pension Yojana (APY) is available for those who are at least 18 years old, and you can join until you’re 40 years old at the most. |

| Both Indians and NRI can invest in this scheme. | Only Indian citizens can enroll in the Atal Pension Yojana. |

| NPS doesn’t assure a pension after you retire. | Atal Pension Yojana guarantees pension after retirement. |

| NPS offers investors in this scheme a tax rebate of up to Rs. 2 lakhs. | Atal Pension Yojana doesn’t provide any tax benefits to the applicant |

| Premature withdrawals are only permitted with Tier 2 accounts. | Under this scheme, withdrawing invested funds before the term ends is generally prohibited. Exceptions include unfortunate events like the investor’s demise or a severe medical condition. |

| NPS offers investors the choice of two account types: Tier 1 and Tier 2. | Atal Pension Yojana provides investors with a single account option. |

| In NPS, investors have the freedom to choose where they want to invest their money. | Atal Pension Yojana doesn’t grant you the privilege of choosing your own investment approach. |

| Contributions in the National Pension Scheme solely come from the investor, without any support from the government. | The Government doesn’t provide any monetary assistance to investors in the Atal Pension Yojana. |

To sum up, NPS and Atal Pension Yojana cater to diverse retirement needs. NPS provides flexibility with wider age and investment options, while Atal Pension Yojana focuses on a specific age group with assured pensions. Both options offer distinct advantages for a secure retirement future.