PAN or Permanent Account Number is a ten-digit unique alphanumeric number issued by the Income Tax Department of India. The PAN is issued in the form of a plastic card with a laminated finish on it.

Significance of the PAN number

The PAN number is a unique code that carries its own significance.

The first three letters in the code represent the alphanumeric series that runs from AAA and goes all the way to ZZZ through several permutations and combinations. The fourth letter of the PAN holds specific significance.

The fourth letter of the PAN represents the status of the PAN card holder.

- P = Individual

- C = Company

- H = Hindu Undivided Family

- A = Association of Persons

- B = Body of Individuals

- G = Government agency

- J = Artificial juridicial person

- L = Local Authority

- F = firm / limited liability partnership

- I = trust

Fifth letter of the PAN represents the surname/last name of the card holder. The next four numbers are sequential numbers running all the way from 0001 to 9999.

The last character of the PAN is an alphabetic check digit.

Use of a PAN card

What are PAN cards used for? Why does one need to have it?

PAN basically enables the Income tax department to identify or link all transactions of the PAN holder with the department. These transactions include tax payments, TDS/TCS credit, returns of income, correspondence, etc.

It also enables retrieval of information of PAN holder and matching of various investments, borrowings and various other business activities of the PAN holder.

How to apply for a PAN card?

The Income tax department acknowledges that issuing a card with such importance nationwide is a huge task. This is a task where efficiency is of prime importance, as any discrepancy will lead to massive ramifications in the long run. Hence, it has entrusted the task to the authorized UTI Infrastructure Technology and Services Limited (UTIITSL) alongside the National Securities Depository Limited (NSDL).

This partnership is essential to set-up and manages PAN service centers all around the nation.

A person wishing to apply for PAN card can do so by submitting the PAN application form – Form 49A/49AA) along with documents necessitated by the government of India. There would also be a nominal fee at the PAN card application center of UTIISL or NSDL.

In order to apply instantly for the PAN card online, here is how you can go about it.

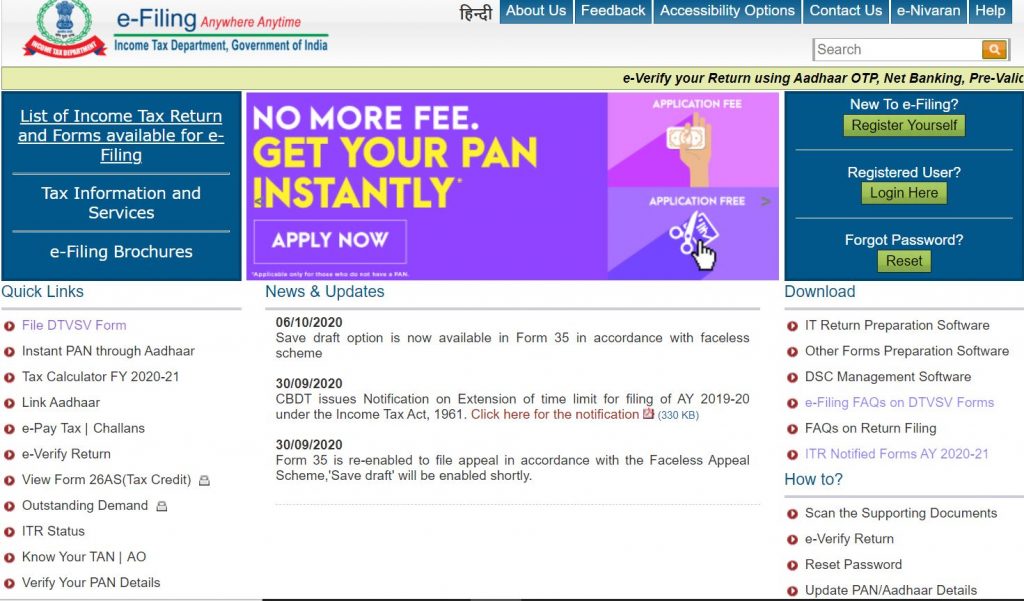

- Go to the official website for PAN card application: https://www.incometaxindiaefiling.gov.in/home

- Click on the link and click on “Instant PAN through AADHAAR” an option that shows on the page. (Highlighted in the section below for your convenience)

- Once you have clicked on that, click on the option – “Get New PAN”

- Enter the Aadhaar number of the applicant

- Enter the OTP received on the mobile number linked to the Aadhaar card

- Validate the Aadhaar details

- Validate e-mail ID

- Download the e-PAN card generated

Who should apply for a PAN card?

PAN card should be possessed by the following persons:

- Every person if his/her total income or the total income of any other person in respect of which he/she is assessable during the previous year exceeds the maximum amount which is not chargeable to tax.

- A charitable trust who is required. To furnish return under Section 139(4A).

- Every person who is a business owner or conducts a profession whose total sale, turnover or gross receipts are/is likely to exceed five lakh rupees in any previous year.

- Every person who intends to enter into specified financial transactions which ideally mandates quoting of a PAN card number.

Documents that serve as proof of identity during the application of PAN card?

- Proof of identity – voter ID, driver’s license, passport, etc

- Proof of address – ration card, electricity bill, etc.

- Proof of date of birth – birth certificate.

Individual should also get along two recent photographs with a white background (ideal dimensions – 3.5 cm x 2.5 cm). The photo should not be stapled or clipped to the form but thoroughly glued.

Clarity of the picture on the card ideally depends on the clarity of picture on the form.

Is holding more than one PAN card possible?

No. A person cannot hold more than one PAN card. If found to be such a case, there would be a penalty of Rs 10,000 under section 272B of the income tax act 1961.

If the person has been allotted more than one PAN card due to some error, the applicant must immediately surrender the additional PAN card(s).

How to link Aadhaar with a PAN card?

Linking Aadhaar to PAN is an important process as they are both essential documents in the long run, and them being synced will prove to be handy for you.

Aadhaar can be linked with PAN in the following ways.

- SMS: The applicant can send an SMS to 567678 from the registered mobile number in the following format. UIDPAN<space><12 digit Aadhaar Number><space>10 digit PAN number>

- Online: The applicant can also do the same online. This can be done by visiting www.utiitsl.com. Click on the ‘Link Aadhaar to PAN’ option which would direct you to the income tax website OR it can also be done directly by visiting the e-filing website – www.incometaxindiaefiling.gov.in

- Paper mode: a less preferable, but yet effective method is to do it through a form submission. File a one-page form along with the minimal fee with the designated PAN centre. Copies of PAN card, Aadhaar card are to be provided along with the application.

Summing it up

There is no doubt as to the importance of PAN card in the Indian economy. Any an every individual who benefits from the economy in any way should have a PAN card registered to his/her name.

PAN card not only makes taxation infinitely easier, but it also serves as a Photo ID proof at several places. Having this document has multifarious advantages, and availing the card should not be delayed at any time.